(25.) A philanthropist sets up an endowment (an account that provides ongoing funds from interest only)

with

$1.8 billion.

(a.) The endowment earns interest at an annual rate of 7.2% compounded monthly.

How much would she give away each year in interest alone (leaving the balance unchanged)?

(b.) If the annual rate drops to 6.5% but is still compounded monthly, does the account generate enough interest to make 120 annual donations of $1 million each?

(c.) Assume that instead of setting up an endowment, the philanthropist decides

(a.) This is a case of Compound Interest

We can do this question using at least two approaches.

Use any approach you prefer.

1st Approach: By Formula

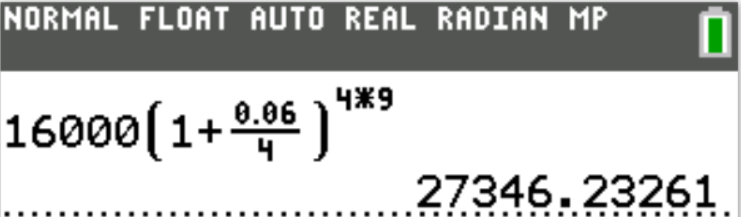

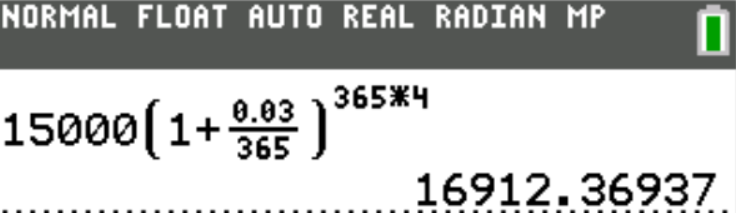

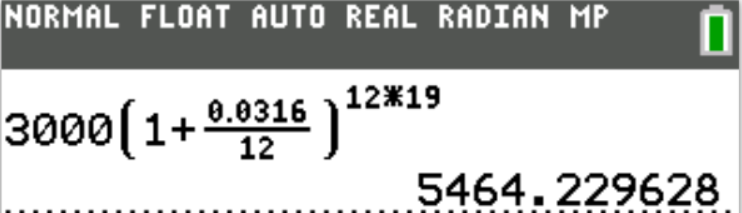

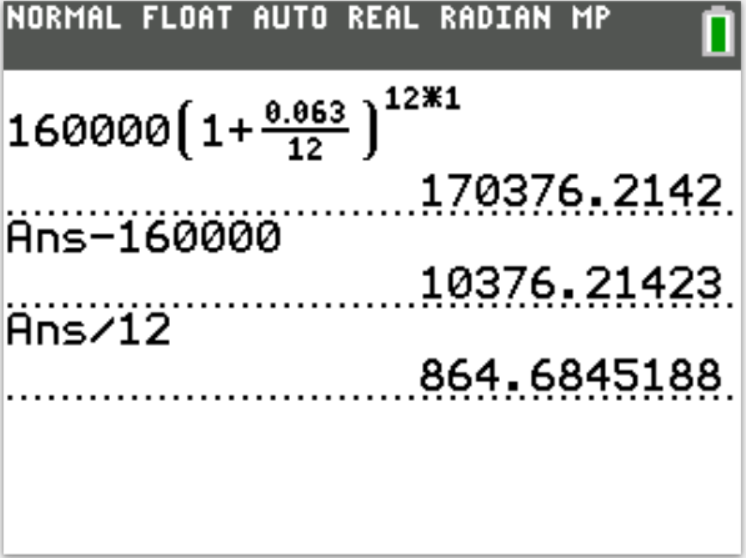

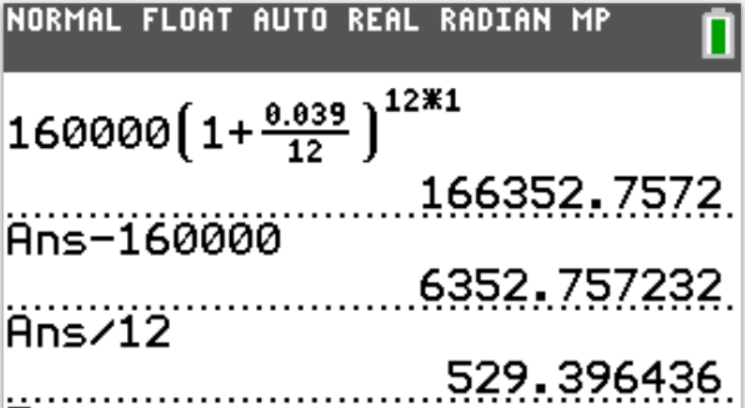

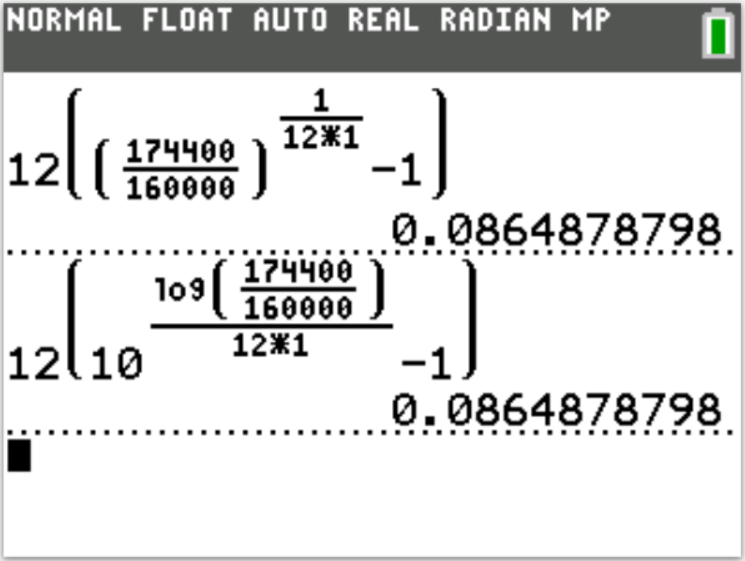

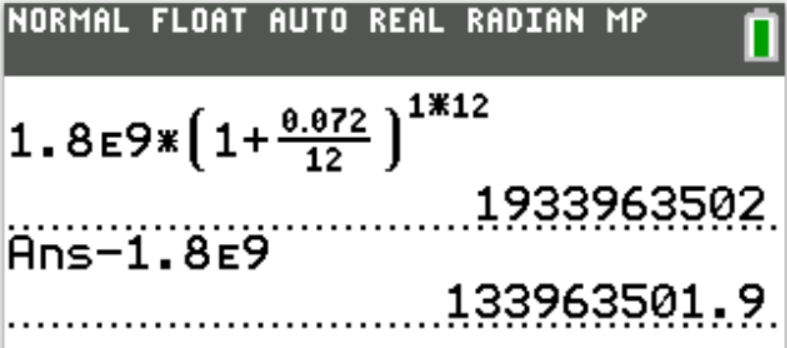

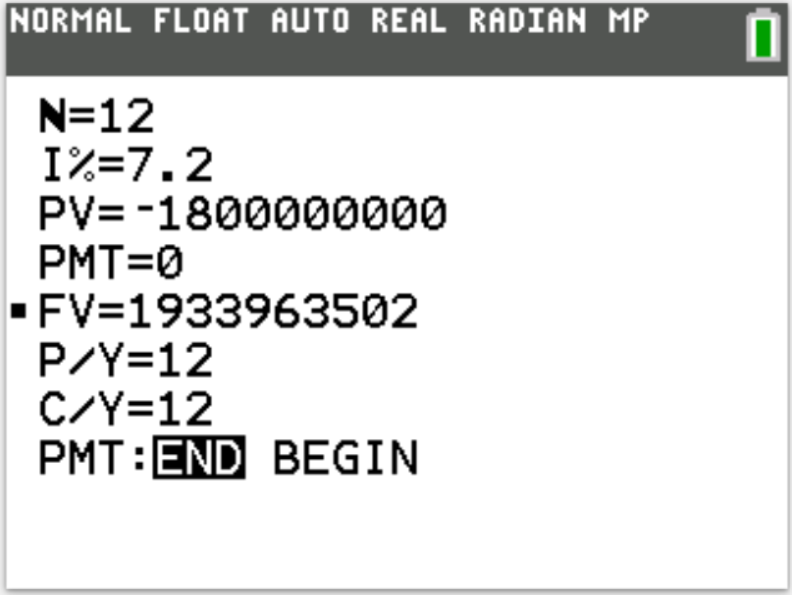

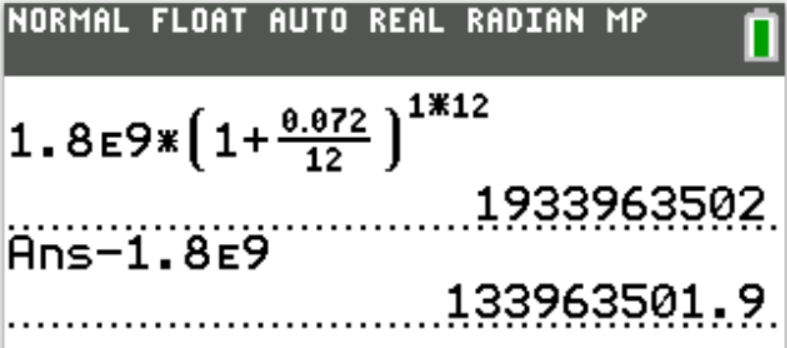

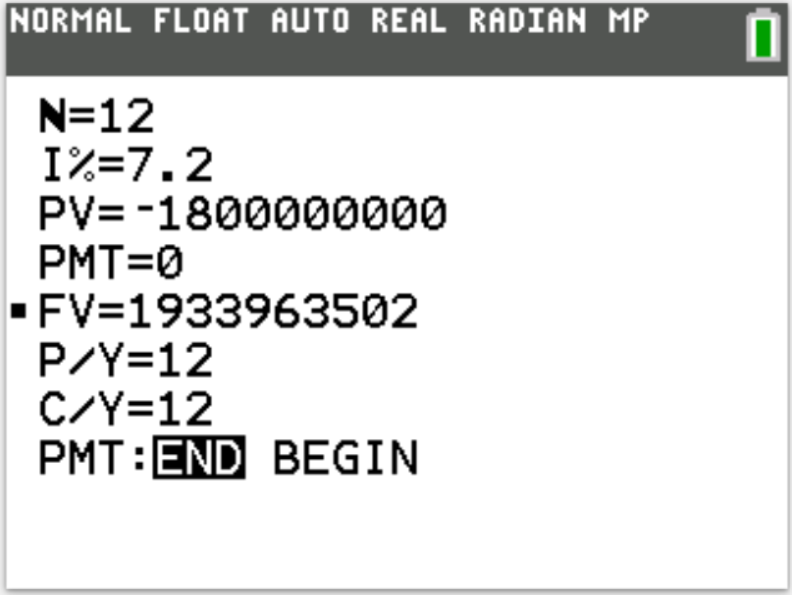

$ (a.) \\[3ex] \underline{Compound\:\:Amount\:\:Formula} \\[3ex] P = 1.8 * 10^9 \\[3ex] r = 7.2\% = \dfrac{7.2}{100} = 0.072 \\[5ex] Compounded\:\:monthly \rightarrow m = 12 \\[3ex] t = 1\:year \\[3ex] A = ? \\[3ex] A = P\left(1 + \dfrac{r}{m}\right)^{mt} \\[5ex] A = 1.8 * 10^9 * \left(1 + \dfrac{0.072}{12}\right)^{12(1)} \\[5ex] A = 1800000000(1 + 0.006)^{12} \\[4ex] A = 1800000000(1.006)^{12} \\[4ex] A = 1800000000(1.074424168) \\[3ex] A = \$1933963502 \\[5ex] \underline{Compound\:\:Interest\:\:Formula} \\[3ex] CI = A - P \\[3ex] CI = 1933963502 - 1800000000 \\[3ex] CI = \$133963502.00 \\[3ex] $ 2nd Approach: By Technology: Texas Instrument (TI) Finance App

$ (b.) \\[3ex] \underline{Compound\:\:Amount\:\:Formula} \\[3ex] P = 1.8 * 10^9 \\[3ex] r = 6.5\% = \dfrac{6.5}{100} = 0.065 \\[5ex] Compounded\:\:monthly \rightarrow m = 12 \\[3ex] t = 1\:year \\[3ex] A = ? \\[3ex] A = P\left(1 + \dfrac{r}{m}\right)^{mt} \\[5ex] A = 1.8 * 10^9 * \left(1 + \dfrac{0.065}{12}\right)^{12(1)} \\[5ex] A = 1800000000(1 + 0.0054166667)^{12} \\[4ex] A = 1800000000(1.005416667)^{12} \\[4ex] A = 1800000000(1.066971852) \\[3ex] A = \$1920549334 \\[5ex] \underline{Compound\:\:Interest\:\:Formula} \\[3ex] CI = A - P \\[3ex] CI = 1920549334 - 1800000000 \\[3ex] CI = \$120549333.60 \\[5ex] (c.) \\[3ex] Giving\;\;away\;\;\$1.8\;\;billion\;\;in\;\;7\;\;years \\[3ex] Amount\;\;per\;\;week\;\;is: \\[3ex] = \dfrac{1.8 * 10^9}{7\;years} * \dfrac{1\;year}{52\;weeks} \\[5ex] = 4945054.945 \\[3ex] \approx \$4945054.95 \;\;per\;\;week $

(a.) The endowment earns interest at an annual rate of 7.2% compounded monthly.

How much would she give away each year in interest alone (leaving the balance unchanged)?

(b.) If the annual rate drops to 6.5% but is still compounded monthly, does the account generate enough interest to make 120 annual donations of $1 million each?

(c.) Assume that instead of setting up an endowment, the philanthropist decides

(a.) This is a case of Compound Interest

We can do this question using at least two approaches.

Use any approach you prefer.

1st Approach: By Formula

$ (a.) \\[3ex] \underline{Compound\:\:Amount\:\:Formula} \\[3ex] P = 1.8 * 10^9 \\[3ex] r = 7.2\% = \dfrac{7.2}{100} = 0.072 \\[5ex] Compounded\:\:monthly \rightarrow m = 12 \\[3ex] t = 1\:year \\[3ex] A = ? \\[3ex] A = P\left(1 + \dfrac{r}{m}\right)^{mt} \\[5ex] A = 1.8 * 10^9 * \left(1 + \dfrac{0.072}{12}\right)^{12(1)} \\[5ex] A = 1800000000(1 + 0.006)^{12} \\[4ex] A = 1800000000(1.006)^{12} \\[4ex] A = 1800000000(1.074424168) \\[3ex] A = \$1933963502 \\[5ex] \underline{Compound\:\:Interest\:\:Formula} \\[3ex] CI = A - P \\[3ex] CI = 1933963502 - 1800000000 \\[3ex] CI = \$133963502.00 \\[3ex] $ 2nd Approach: By Technology: Texas Instrument (TI) Finance App

$ (b.) \\[3ex] \underline{Compound\:\:Amount\:\:Formula} \\[3ex] P = 1.8 * 10^9 \\[3ex] r = 6.5\% = \dfrac{6.5}{100} = 0.065 \\[5ex] Compounded\:\:monthly \rightarrow m = 12 \\[3ex] t = 1\:year \\[3ex] A = ? \\[3ex] A = P\left(1 + \dfrac{r}{m}\right)^{mt} \\[5ex] A = 1.8 * 10^9 * \left(1 + \dfrac{0.065}{12}\right)^{12(1)} \\[5ex] A = 1800000000(1 + 0.0054166667)^{12} \\[4ex] A = 1800000000(1.005416667)^{12} \\[4ex] A = 1800000000(1.066971852) \\[3ex] A = \$1920549334 \\[5ex] \underline{Compound\:\:Interest\:\:Formula} \\[3ex] CI = A - P \\[3ex] CI = 1920549334 - 1800000000 \\[3ex] CI = \$120549333.60 \\[5ex] (c.) \\[3ex] Giving\;\;away\;\;\$1.8\;\;billion\;\;in\;\;7\;\;years \\[3ex] Amount\;\;per\;\;week\;\;is: \\[3ex] = \dfrac{1.8 * 10^9}{7\;years} * \dfrac{1\;year}{52\;weeks} \\[5ex] = 4945054.945 \\[3ex] \approx \$4945054.95 \;\;per\;\;week $

(26.) If the inflation rate is 2.95% compounded annually, how long will it take for prices to double?

We are not given the value of the principal

So, we can assume it to be $1

In that case, doubling $1

= 1 * 2

= 2

This implies that:

P = $1

A = $2

You can certainly do it that way.

But I would like to do the question algebrically rather than arithmetically. $ r = 2.95\% = \dfrac{2.95}{100} = 0.0295 \\[5ex] Compounded\:\:annually\rightarrow m = 1 \\[3ex] P = P \\[3ex] A = 2P...double\:\:P \\[3ex] t = ? \\[3ex] t = \dfrac{\log\left(\dfrac{A}{P}\right)}{m\log\left(1 + \dfrac{r}{m}\right)} \\[7ex] t = \dfrac{\log\left(\dfrac{2P}{P}\right)}{1 * \log\left(1 + \dfrac{0.0295}{1}\right)} \\[7ex] t = \dfrac{\log 2}{1 * \log(1 + 0.0295)} \\[5ex] t = \dfrac{\log 2}{1 * \log(1.0295)} \\[5ex] t = \dfrac{\log 2}{\log(1.0295)} \\[5ex] t = \dfrac{0.3010299957}{0.01262635095} \\[5ex] t = 23.84140888 \\[3ex] t \approx 23.84\:years $

We are not given the value of the principal

So, we can assume it to be $1

In that case, doubling $1

= 1 * 2

= 2

This implies that:

P = $1

A = $2

You can certainly do it that way.

But I would like to do the question algebrically rather than arithmetically. $ r = 2.95\% = \dfrac{2.95}{100} = 0.0295 \\[5ex] Compounded\:\:annually\rightarrow m = 1 \\[3ex] P = P \\[3ex] A = 2P...double\:\:P \\[3ex] t = ? \\[3ex] t = \dfrac{\log\left(\dfrac{A}{P}\right)}{m\log\left(1 + \dfrac{r}{m}\right)} \\[7ex] t = \dfrac{\log\left(\dfrac{2P}{P}\right)}{1 * \log\left(1 + \dfrac{0.0295}{1}\right)} \\[7ex] t = \dfrac{\log 2}{1 * \log(1 + 0.0295)} \\[5ex] t = \dfrac{\log 2}{1 * \log(1.0295)} \\[5ex] t = \dfrac{\log 2}{\log(1.0295)} \\[5ex] t = \dfrac{0.3010299957}{0.01262635095} \\[5ex] t = 23.84140888 \\[3ex] t \approx 23.84\:years $