I greet you this day,

First: read the notes/eText.

Second: view the videos/multimedia resources.

Third: solve the questions/solved examples.

Fourth: check your solutions with my thoroughly-explained solutions.

Comments, ideas, areas of improvement, questions, and constructive criticisms are welcome.

Thank you.

Samuel Dominic Chukwuemeka (SamDom For Peace) B.Eng.,A.A.T, M.Ed., M.S

Mathematics of Finance

Objectives

Students will:

(1.) Discuss the basics of Financial Literacy.

(2.) Solve applied problems on financial literacy.

(3.) Discuss the topic of Simple Interest.

(4.) Solve applied problems on simple interest.

(5.) Discuss the topic of Compound Interest.

(6.) Solve applied problems on compound interest.

(7.) Discuss the topic of Continuous Compound Interest.

(8.) Solve applied problems on continuous compound interest.

(9.) Discuss the topic of Annual Percentage Yield.

(10.) Solve applied problems on annual percentage yield.

(11.) Discuss several investments for retirement.

(12.) Discuss the topic of Ordinary Annuity.

(13.) Solve applied problems on ordinary annuity.

(14.) Discuss the topic of Annuity Due.

(15.) Solve applied problems on annuity due.

(16.) Discuss the topic of Amortization.

(17.) Solve applied problems on amortization.

(18.) Discuss the topic of Sinking Fund.

(19.) Solve applied problems on sinking fund.

(20.) Discuss the Rule of 78.

(21.) Solve applied problems on the rule of 78.

(22.) Discuss the buying of a car in the United States.

(23.) Discuss the buying of a home in the United States.

(24.) Discuss the topic of Personal Income Taxes.

(25.) Solve applied problems on personal income taxes.

(26.) Solve finance problems using technology Texas Instruments (TI) calculators.

Skills Measured/Acquired

(1.) Use of prior knowledge

(2.) Critical Thinking

(3.) Interdisciplinary connections/applications

(4.) Technology

(5.) Active participation through direct questioning

(6.) Research

NOTE: Unless instructed otherwise;

For all financial calculations, do not round until the final answer.

Do not round intermediate calculations. If it is too long, write it to at least 5 decimal

places (5 or more decimal places).

Round your final answer to 2 decimal places.

Make sure you include the unit.

Symbols and Meanings

- $Per\:\:annum$ OR $Per\:\:year$ OR $Annually$ OR $Yearly$ means for a year (per $1$ year)

- $SI$ OR $I$ = Simple Interest or Dividend or Yield or Return ($)

- $P$ = Principal or Present Value or Investment ($)

- $r$ = Rate or Annual Interest Rate or Annual Percentage Rate (%)

- $APR$ = Rate or Annual Percentage Rate (%)

- $t$ = Time $(years)$

- $A$ = Amount or Future Value ($)

- $CI$ OR $I$ = Compound Interest or Yield or Dividend or Return($)

- $m$ = Number of Compounding Periods Per Year

- $n$ = Total Number of Compounding Periods $(years)$

- $i$ = Interest Rate Per Period $(\%) \:\:per\:\: period$

- $CCI$ = Continuous Compound Interest or Yield or Dividend or Return($)

- $APY$ = Annual Percentage Yield or Effective Interest Rate or True Interest Rate (%)

- $FV$ = Future Value ($)

- $PMT$ = periodic payment ($)

- $PMTs$ = total periodic payments ($)

- $PV$ = Present Value of all payments ($)

- $a_{n\i}$ = $a$ angle $n$ at $i$

- $s_{n\i}$ = $s$ angle $n$ at $i$

- $PV$ = Present Value of all payments ($)

- $payoff$ = payoff amount for a mortgage

- $k$ = number of remaining payments

- $CFV$ = Combined Future Value ($)

- Rule of $78$

- $UI$ = Unearned Interest or Interest Refund ($)

- $PMT$ = Monthly Payment ($)

- $k$ = Number of remaining monthly payments OR remaining number of monthly payments

- $TI$ = Total Interest ($)

- $n$ = original number of payments

- $TP$ = Total Payments ($)

- $LA$ = Loan Amount or Finance Charge ($)

- $RF$ = Refund Fraction

- $LAR$ = Loan Amount Refund or Finance Charge Refund ($)

- Bonds

- $CP$ = Coupon Payment ($)

- $CR$ = Coupon Rate (%)

- $FV$ = Face Value or Par Value of the Bond ($)

-

$m$ = Number of Coupon Payments per year

This is similar to the number of compounding periods per year. - $BP$ = Bond Price ($)

- $YTM$ = Yield to Maturity ($\%$)

- $t$ = time to reach maturity (years)

- $Annualized\:\:YTM$ = Annualized Yield to Maturity ($\%$)

NOTE: Unless instructed otherwise;

For all financial calculations, do not round until the final answer.

Do not round intermediate calculations. If it is too long, write it to at least 5 decimal

places (5 or more decimal places).

Round your final answer to 2 decimal places.

Make sure you include the unit.

Formulas

Financial Mathematics Literacy

(1.) Monthly interest payment = Monthly interest rate * Average balance

(2.) Net monthly cash flow = Monthly income − Monthly expenses

Simple Interest

$ (1.)\:\: SI = Prt \\[3ex] (2.)\:\: SI = A - P \\[3ex] (3.)\:\: P = \dfrac{SI}{rt} \\[5ex] (4.)\:\: t = \dfrac{SI}{Pr} \\[5ex] (5.)\:\: r = \dfrac{SI}{Pt} \\[5ex] (6.)\:\: A = P + SI \\[3ex] (7.)\:\: A = P(1 + rt) \\[3ex] (8.)\:\: P = \dfrac{A}{1 + rt} \\[5ex] (9.)\:\: t = \dfrac{A - P}{Pr} \\[5ex] (10.)\:\: r = \dfrac{A - P}{Pt} \\[5ex] (11.)\:\: SI = \dfrac{Art}{1 + rt} $

Compound Interest

$

(1.)\:\: A = P\left(1 + \dfrac{r}{m}\right)^{mt} \\[7ex]

(2.)\:\: P = \dfrac{A}{\left(1 + \dfrac{r}{m}\right)^{mt}} \\[10ex]

(3.)\:\: r = m\left[\left(\dfrac{A}{P}\right)^{\dfrac{1}{mt}} - 1\right] \\[10ex]

(4.)\:\: r = m\left(10^{\dfrac{\log\left(\dfrac{A}{P}\right)}{mt}} - 1\right) \\[10ex]

(5.)\:\: t = \dfrac{\log\left(\dfrac{A}{P}\right)}{m\log\left(1 + \dfrac{r}{m}\right)} \\[7ex]

(6.)\:\: A = P + CI \\[3ex]

(7.)\:\: CI = A - P \\[3ex]

(8.)\:\: A = P(1 + i)^n \\[4ex]

(9.)\:\: P = \dfrac{A}{(1 + i)^n} \\[7ex]

(10.)\:\: i = \dfrac{r}{m} \\[5ex]

(11.)\:\: n = mt \\[3ex]

(12.)\;\; Total\;\;Return = \dfrac{A - P}{P} * 100\% \\[7ex]

(13.)\;\; Annual\;\;Return = \left[\left(\dfrac{A}{P}\right)^{\dfrac{1}{t}} - 1\right] * 100\% \\[7ex]

$

Future Value (Amount) of Cash Flows (Principal) for Several Years

$

(13.)\:\:At\:\:the\:\:end\:\:of\:\:each\:\:year:\:\: FV = PV\left(1 +

\dfrac{r}{m}\right)^{m(last\:\:year - that\:\:year)} \\[7ex]

(14.)\:\: Total\:FV = \Sigma FV

$

Values of $m$

| If Compounded: | m = |

|---|---|

| Annually |

$1$ ($1$ time per year) Also means every twelve months |

| Semiannually |

2 (2 times per year) Also means every six months |

| Quarterly |

4 (4 times per year) Also means every three months |

| Monthly |

12 (12 times per year) Also means every month |

| Weekly | 52 (52 times per year) |

| Daily (Ordinary/Banker's Rule) | 360 (360 times per year) |

| Daily (Exact) | 365 (365 times per year) |

Continuous Compound Interest

$ (1.)\:\: A = Pe^{rt} \\[4ex] (2.)\:\: P = \dfrac{A}{e^{rt}} \\[7ex] (3.)\:\: t = \dfrac{\ln \left(\dfrac{A}{P}\right)}{r} \\[7ex] (4.)\:\: r = \dfrac{\ln \left(\dfrac{A}{P}\right)}{t} \\[7ex] (5.)\;\; Total\;\;Return = \dfrac{A - P}{P} * 100\% \\[7ex] (6.)\;\; Annual\;\;Return = \left[\left(\dfrac{A}{P}\right)^{\dfrac{1}{t}} - 1\right] * 100\% $

APY for Compound Interest

$ (1.)\:\: APY = \left(1 + \dfrac{r}{m}\right)^m - 1 \\[7ex] (2.)\:\: r = m\left[(APY + 1)^{\dfrac{1}{m}} - 1\right] \\[7ex] (3.)\:\: r = m\left(\sqrt[m]{APY + 1} - 1\right) $

APY for Continuous Compound Interest

$ (1.)\:\: APY = e^r - 1 \\[4ex] (2.)\:\: r = \ln(APY + 1) $

Investments

(1.) Market Capitalization (Market Cap) = Total Number of Outstanding Shares * Current Share Price

Income Taxes

(1.) Gross income (GI) = sum of all Income a person receives during the year, including wages, tips,

profits from a business, interest or dividends from investments.

(2.) Adjusted Gross Income (AGI) = Gross Income − Contributions for individual retirement accounts

or any other tax-deferred savings plans

(3.) Taxable Income (TI) = Adjusted Gross Income − Exemptions and Deductions

Between Standard deduction and Itemized deductions, use whichever is higher.

(4.) If Standard Deduction > Itemized Deductions:

Use Standard Deduction

Savings in Taxable Income = Standard Deduction − Itemized Deductions

(5.) If Itemized Deductions > Standard Deductions:

Use Itemized Deductions

Savings in Taxable Income = Itemized Deductions − Standard Deduction

Future Value of Ordinary Annuity

$ (1.)\:\: FV = m * PMT * \left[\dfrac{\left(1 + \dfrac{r}{m}\right)^{mt} - 1}{r}\right] \\[10ex] (2.)\;\; FV = PMT * \dfrac{\left[\left(1 + \dfrac{r}{m}\right)^{mt} - 1\right]}{\dfrac{r}{m}} \\[10ex] (3.)\:\: t = \dfrac{\log\left[\dfrac{r * FV}{m * PMT} + 1\right]}{m * \log\left(1 + \dfrac{r}{m}\right)} \\[10ex] (4.)\:\: Total\:\:PMTs = PMT * m * t \\[3ex] (5.)\:\: CI = FV - Total\:\:PMTs \\[5ex] (6.)\:\: FV = PMT * \left[\dfrac{(1 + i)^n - 1}{i}\right] \\[7ex] (7.)\:\: n = \dfrac{\log\left[\dfrac{i * FV}{PMT} + 1\right]}{\log(1 + i)} \\[10ex] (8.)\:\: s_{n\i} = \dfrac{m}{r} * \left[\left(1 + \dfrac{r}{m}\right)^{mt} - 1\right] \\[7ex] (9.)\:\: s_{n\i} = \dfrac{(1 + i)^n - 1}{i} \\[5ex] (10.)\:\: FV = PMT * s_{n\i} \\[3ex] (11.)\:\: i = \dfrac{r}{m} \\[5ex] (12.)\:\: n = mt \\[3ex] (13.)\:\: Annual\:\:Fuel\:\:Expense = \dfrac{Annual\:\:Miles\:\:Driven}{Miles\:\:per\:\:Gallon} * Price\:\:per\:\:Gallon $

Sinking Fund

$ (1.)\:\: PMT = \dfrac{r * FV}{m * \left[\left(1 + \dfrac{r}{m}\right)^{mt} - 1\right]} \\[10ex] (2.)\:\: t = \dfrac{\log\left[\dfrac{r * FV}{m * PMT} + 1\right]}{m * \log\left(1 + \dfrac{r}{m}\right)} \\[10ex] (3.)\:\: Total\:\:PMTs = PMT * m * t \\[3ex] (4.)\:\: CI = FV - Total\:\:PMTs \\[3ex] (5.)\:\: PMT = \dfrac{i * FV}{(1 + i)^n - 1} \\[7ex] (6.)\:\: n = \dfrac{\log\left[\dfrac{i * FV + PMT}{PMT}\right]}{\log(1 + i)} \\[10ex] (7.)\:\: s_{n\i} = \dfrac{m}{r} * \left[\left(1 + \dfrac{r}{m}\right)^{mt} - 1\right] \\[7ex] (8.)\:\: s_{n\i} = \dfrac{(1 + i)^n - 1}{i} \\[5ex] (9.)\:\: i = \dfrac{r}{m} \\[5ex] (10.)\:\: n = mt $

Present Value of Ordinary Annuity

$ (1.)\:\: PV = m * PMT * \left[\dfrac{1 - \left(1 + \dfrac{r}{m}\right)^{-mt}}{r}\right] \\[10ex] (2.)\:\: t = -\dfrac{\log\left[1 - \dfrac{r * PV}{m * PMT}\right]}{m * \log\left(1 + \dfrac{r}{m}\right)} \\[10ex] (3.)\:\: PV = PMT * \left[\dfrac{1 - (1 + i)^{-n}}{i}\right] \\[7ex] (4.)\:\: n = \dfrac{\log \left[\dfrac{PMT}{PMT - i * PV}\right]}{\log(1 + i)} \\[10ex] (5.)\:\: a_{n\i} = \dfrac{m}{r} * \left[1 - \left(1 + \dfrac{r}{m}\right)^{-mt}\right] \\[7ex] (6.)\:\: a_{n\i} = \dfrac{1 - (1 + i)^{-n}}{i} \\[5ex] (7.)\:\: PV = PMT * a_{n\i} \\[3ex] (8.)\:\: i = \dfrac{r}{m} \\[5ex] (9.)\:\: n = mt \\[3ex] (10.)\:\: Total\:\:PMTs = PMT * m * t \\[3ex] (11.)\:\: CI = Total\:\:PMTs - PV $

Amortization

$ (1.)\:\: PMT = \dfrac{PV}{m} * \left[\dfrac{r}{1 - \left(1 + \dfrac{r}{m}\right)^{-mt}}\right] \\[10ex] (2.)\:\: t = -\dfrac{\log\left[1 - \dfrac{r * PV}{m * PMT}\right]}{m * \log\left(1 + \dfrac{r}{m}\right)} \\[10ex] (3.)\:\: PMT = \dfrac{i * PV}{1 - (1 + i)^{-n}} \\[7ex] (4.)\:\: n = \dfrac{\log \left[\dfrac{PMT}{PMT - i * PV}\right]}{\log(1 + i)} \\[10ex] (5.)\:\: i = \dfrac{r}{m} \\[5ex] (6.)\:\: n = mt \\[3ex] (7.)\:\: Payoff = PMT * n * \left[\dfrac{1 - \left(1 + \dfrac{r}{n}\right)^{-k}}{r}\right] \\[10ex] (8.)\:\: Total\:\:PMTs = PMT * m * t \\[3ex] (9.)\:\: CI = Total\:\:PMTs - PV \\[3ex] (10.)\:\: CI = PMT * m * t - PV \\[3ex] (11.)\:\: Number\:\:of\:\:payments = m * t \\[3ex] (12.)\:\: Down\:\:Payment = Given\:\:Rate * Purchase\:\:Price \\[3ex] (13.)\:\: Amount\:\:of\:\:Mortgage = Purchase\:\:Price - Down\:\:Payment \\[3ex] (14.)\:\: Payment\:\:for\:\:x\:\:points\:\:at\:closing = x\:\:as\:\:\% * Amount\:\:of\:\:Mortgage $

Future Value of an Annuity Due

$ (1.)\:\: FV = m * PMT * \left[\dfrac{\left(1 + \dfrac{r}{m}\right)^{mt} - 1}{r}\right] * \left(1 + \dfrac{r}{m}\right) \\[10ex] (2.)\:\: PMT = \dfrac{r * FV}{(m + r) * \left[\left(1 + \dfrac{r}{m}\right)^{mt} - 1\right]} \\[10ex] (3.)\:\: t = \dfrac{\log\left[\dfrac{r * FV}{PMT(m + r)} + 1\right]}{m * \log\left(1 + \dfrac{r}{m}\right)} \\[10ex] (4.)\:\: Total\:\:PMTs = PMT * m * t \\[3ex] (5.)\:\: CI = FV - Total\:\:PMTs \\[3ex] (6.)\:\: FV = PMT * \left[\dfrac{(1 + i)^n - 1}{i}\right] * (1 + i) \\[7ex] (7.)\:\: PMT = \dfrac{i * FV}{(1 + i)\left[(1 + i)^n - 1\right]} \\[7ex] (8.)\:\: n = \dfrac{\log\left[\dfrac{i * FV}{PMT(1 + i)} + 1\right]}{\log(1 + i)} \\[10ex] (9.)\:\: i = \dfrac{r}{m} \\[5ex] (10.)\:\: n = mt \\[3ex] (11.)\:\: CFV = P\left(1 + \dfrac{r}{m}\right)^{mt} + m * PMT * \left[\dfrac{\left(1 + \dfrac{r}{m}\right)^{mt} - 1}{r}\right] * \left(1 + \dfrac{r}{m}\right) \\[10ex] (12.)\:\: t = \dfrac{\log\left[\dfrac{rCFV + PMT(m + r)}{rP + PMT(m + r)}\right]}{m\log\left(1 + \dfrac{r}{m}\right)} $

Rule of 78

$ \underline{Monthly} \\[3ex] (1.)\:\: UI = \dfrac{TI * k * (k + 1)}{n(n + 1)} \\[5ex] (2.)\:\: TP = n * PMT \\[3ex] (3.)\:\: TI = TP - LA \\[3ex] (4.)\:\: RF = \dfrac{UI}{TI} \\[5ex] (5.)\:\: RF = \dfrac{sum\:\:of\:\:digits\:\:for\:\:up\:\:to\:\:k}{sum\:\:of\:\:digits\:\:for\:\:up\:\:to\:\:n} \\[5ex] (6.)\:\: LAR = LA * RF \\[3ex] (7.)\:\: UI = TI * RF $

Zero-Coupon Bonds

$ (1.)\:\: CP = \dfrac{CR * FV}{m} \\[7ex] (2.)\:\: YTM = \left(\dfrac{FV}{BP}\right)^{\dfrac{1}{t}} - 1 \\[7ex] (3.)\:\: BP = \dfrac{FV}{(YTM + 1)^t} \\[7ex] (4.)\:\: FV = BP * (YTM + 1)^t \\[5ex] (5.)\:\: t = \dfrac{\log\left(\dfrac{FV}{BP}\right)}{\log(YTM + 1)} $

Coupon Bonds

$ (1.)\:\: CP = \dfrac{CR * FV}{m} \\[5ex] (2.)\:\: BP = \dfrac{FV * CR}{YTM} * \left[1 - \dfrac{1}{\left(1 + \dfrac{YTM}{m}\right)^{mt}}\right] + \dfrac{FV}{\left(1 + \dfrac{YTM}{m}\right)^{mt}} \\[10ex] (3.)\:\: YTM \approx \dfrac{m * t * CP + FV - BP}{t(FV + BP)} \\[7ex] (4.)\:\: Annualized\:\:YTM \approx \dfrac{2(m * t * CP + FV - BP)}{t(FV + BP)} \\[7ex] (5.)\:\: YTM \approx \dfrac{t * CR * FV + FV - BP}{t(FV + BP)} \\[7ex] (6.)\:\: Annualized\:\:YTM \approx \dfrac{2(t * CR * FV + FV - BP)}{t(FV + BP)} \\[7ex] $

NOTE: Unless instructed otherwise;

For all financial calculations, do not round until the final answer.

Do not round intermediate calculations. If it is too long, write it to at least 5 decimal

places (5 or more decimal places).

Round your final answer to 2 decimal places.

Make sure you include the unit.

Simple Interest

Discuss savings account.

Discuss the importance and benefits of credit unions over banks.

Use these "personal experience" examples and others as time demands:

(1.) Alabama Teachers Credit Union

(2.) Wells Fargo

Simple Interest is a topic discussed in Financial Mathematics, Finite Mathematics, Business Mathematics,

Financial Management, and other finance/business classes.

Say you:

(1.) Wanted to save some money OR set aside some money for a rainy day

(2.) Opened a savings account with a financial institution such as a credit union or a bank

(3.) Deposited some money into that savings account

That initial sum of money you deposited is known as the Principal or Principal sum of

money

or Investment

The financial institution uses your money for financial transactions including lending loans to

individuals and businesses among others.

That money you deposited (Principal) is supposed to give you an extra money over a certain

period of

time.

That extra money you get over a period of time due to the initial money you deposited is known

as

Simple Interest or Dividend or Yield or Return

This is because the individuals or businesses that borrowed the loans from the financial institution

(which used your money)

pay back those loans with some extra money.

So, the financial institution gives you a portion of that interest.

Classroom Discussion

For Educational Purposes only (I do not teach any religion in the classroom):

Psalm 15:5 (Christians) and Quran 2:276 (Muslims) and Torah: Exodus 22:25 (Jews) talks against

lending money with interest.

So, why do we charge interest on money borrowed?

Why do we lend money with interest?

Teacher: Why would an individual or the financial institution charge the extra money

(interest) on the loans they give to

an individual or business?

Student: Because they traded with your money.

Teacher: Partly, yes. But not fully.

Student: Why not fully?

What are the other reasons?

Teacher: Assume someone, say your friend asks you to lend him some money.

Assume you wanted to use that money to purchase land.

But you realize that your friend's need for your money is probably a higher priority

You decide to lend him the money if he promises to pay back within a month

This is because you really wanted to purchase that land because it was listed for a reasonable price

you could afford

Your friend did not pay back the money in a month.

Did not pay back in two, three, four, ..., ten months.

He pays you back the money in a year

You found out that the land you wanted to purchase has appreciated in value, and hence was listed at

a higher price

Would you be happy if your friend pays you the exact amount he borrowed from you?

Student: Not really

Teacher: Why?

Student: Because I can no longer purchase the land for the amount I loaned him...due to

Inflation.

We just covered the topic of Index Numbers...remember?

Rarely have we had deflation. It's always been inflation and the inflation rate has been increasing

for the most part.

Teacher: Makes sense.

But, what if you could still purchase the land for that amount or for a lesser amount?

As someone taught by Mr. C (this is my advice, you are encouraged to think for yourselves and decide for

yourselves); you should:

Look for credit unions with free savings accounts: no conditions except the one-time $\$25.00$

membership fee (which is refunded to you upon closing the account)

Look for credit union(s) with okay interest rates on savings accounts.

Small interest is better than no interest.

Again, take note: no conditions except the membership fee.

Look for credit union(s) with free checking accounts. Absolutely no conditions except the membership

fee.

Look for credit union(s) with okay interest rates on checking accounts.

This may have some conditions, but it should be fair conditions that you can meet without worries.

Regardless of any conditions for receiving an interest on the checking account, there should definitely

be no penalty whatsoever.

Depending on the instruction time, give some examples of these credit unions

Some students may ask the advantage of using banks over credit unions.

Be prepared to answer those questions.

Say someone deposited:

an initial sum of money, $P$ in dollars, naira, yen, etc.

into a financial institution that gives an interest rate, $r$ in percent

then, after some time, $t$ in years

the person will earn a simple interest, $SI$ in dollars, naira, yen, etc.

where the $Simple\:\:Interest = Principal * rate * time$

The total amount the person receives will now be the sum of the principal and the simple interest

earned.

$Amount = Principal + Simple\:\:Interest$

OR

Say someone borrowed:

an initial sum of money, $P$ in dollars, naira, yen, etc.

from a financial institution that charges an interest rate, $r$ in percent

then, after some time, $t$ in years

the person will owe a simple interest, $SI$ in dollars, naira, yen, etc.

where the $Simple\:\:Interest = Principal * rate * time$

The total amount the person will pay back will now be the sum of the principal and the

simple

interest earned.

$Amount = Principal + Simple\:\:Interest$

The Principal is the initial sum of money deposited in a financial institution for the

purpose of earning an interest. OR

the initial sum of money borrowed from a financial institution for the purpose of paying an interest.

It is also known as Investment

The Simple Interest is the sum of money earned when a principal is deposited, or charged when a

principal is borrowed; at

a certain rate over a period of time.

Please write all the formulas that you see under Simple Interest and let us

solve some examples

NOTE: Unless instructed otherwise;

For all financial calculations, do not round until the final answer.

Do not round intermediate calculations. If it is too long, write it to at least 5 decimal

places (5 or more decimal places).

Round your final answer to 2 decimal places.

Make sure you include the unit.

Compound Interest

To explain the concept of Compound Interest, let us analyze the two cases:

Case 1 and Case 2 and the two tables: Table 1 and Table 2

Case 1:

Say you deposited an initial sum of money, $1000.00 in a financial institution that has an

interest

rate of 10%

How much would you have after 3 years?

Table 1

| $Year$ | $P(\$)$ | $r(\%)$ | $t(years)$ | $SI(\$)$ | $A(\$)$ |

|---|---|---|---|---|---|

| $1$ | $1000$ | $0.1$ | $1$ | $100$ | $1100$ |

| 2 | $1000$ | $0.1$ | $1$ | $100$ | $1200$ |

| $3$ | $1000$ | $0.1$ | $1$ | $100$ | $1300$ |

Interest after $3$ years = $100 + 100 + 100 = \$300$

Amount after $3$ years = $\$1300$

Teacher: Is this familiar to you - what we just did?

Student: Why would you do it by using a Table?

It is much easier to use the Simple Interest Formula!

Teacher: That is correct. However, observe the second table: Table 2

I want to teach you something 😊

Case 2:

Say you deposited an initial sum of money, $1000.00 in a financial institution that has an

interest

rate of 10% compounded once (one time) per year.

How much would you have after 3 years?

Table 2

| $Year$ | $P(\$)$ | $r(\%)$ | $t(years)$ | $CI(\$)$ | $A(\$)$ |

|---|---|---|---|---|---|

| $1$ | $1000$ | $0.1$ | $1$ | $100$ | $1100$ |

| 2 | $1100$ | $0.1$ | $1$ | $110$ | $1210$ |

| $3$ | $1210$ | $0.1$ | $1$ | $121$ | $1331$ |

Interest after $3$ years = $100 + 110 + 121 = \$331$

Amount after $3$ years = $\$1331$

Teacher: What did you notice?

Student: The interest is $\$331$

It is $\$31$ greater than the interest in Table 1

Teacher: Correct!

What else?

Student: The amount in Table 2 is also greater than the amount in Table 1 by $\$31$

Teacher: That is right.

Is that all?

This leads to ...

Compound Interest

As noticed from Table 2:

The amount at the end of Year 1 is the principal at the beginning of Year 2

The amount at the end of Year 2 is the principal at the beginning of Year 3

This implies that the interest is compounded.

Compound Interest is the interest compounded on a principal sum of money over a period of time.

It is the interest on the principal plus interest.

In the example we just did, (Table 2), the interest was compounded every year.

In other words, the interest was compounded annually or yearly

In other words, the interest was compounded once every year

If the interest is compounded annually, it is compounded once (1) time a year (every

twelve months)

If the interest is compounded semiannually, it is compounded twice (2) times a year (every

six months)

If the interest is compounded quarterly, it is compounded four (4) times a year (every

three months)

If the interest is compounded monthly, it is compounded twelve (12) times a year (every

month)

If the interest is compounded weekly, it is compounded fifty two (52) times a year

If the interest is compounded ordinary daily, it is compounded three hundred and sixty (360)

times a year

If the interest is compounded exact daily, it is compounded three hundred and sixty five (365)

times a year

Student: What if we want to compound it 1000 times a year, what is called?

Teacher: We can. But, these are the standard compounding periods.

We can compound it as many times as you want per year.

Student: Which interest is greater - compounding the same amount annually versus

semiannually?

Teacher: You are asking great questions.

What do you think?

Student: I think compounding it semiannually will give more interest than compounding it

annually

Teacher: You are correct.

Student: So, I guess some people or most people would want it to be compounded a million

times a

year.

Is there any limit on how many times you can compound in a year?

Teacher: Great question!

We shall answer that question when we do Continuous Compound Interest

As you see,

There is a difference between "daily - ordinary (ordinary days)" and "daily - exact (exact days)" in a

year.

Daily - Ordinary is 360 days in a year.

It is also known as Banker's Rule.

It is taken as a year consisting of 12 months in which each month consists of 30 days.

Exact - Ordinary is 365 days in a year.

Teacher: Rather than using Table 2, is there any way we could have calculated the compound

interest and the compound amount?

What if we wanted to compound annually for a period of 30 years?

Student: That would be a "yuge" table

Teacher: LOL...

So, yes, we can do it another way.

Student: Is is a simpler way?

Teacher: Of course. Algebraically: By Formula

Let us derive that formula. Let us do some Algebra.

Let us use that Table and use variables with it.

| Year | $P(\$)$ | $r(\%)$ | $t(years)$ | $CI(\$)$ | $A(\$)$ |

|---|---|---|---|---|---|

| $1$ | $P$ | $r$ | $t$ | $Prt$ |

$P + Prt$ $P(1 + rt)$ |

| 2 | $P(1 + rt)$ | $r$ | $t$ | $Prt(1 + rt)$ |

$P(1 + rt) + Prt(1 + rt)$ $P(1 + rt)[1 + rt]$ $P(1 + rt)^2$ |

| $3$ | $P(1 + rt)^2$ | $r$ | $t$ | $Prt(1 + rt)^2$ |

$P(1 + rt) + Prt(1 + rt)$ $P(1 + rt)^2[1 + rt]$ $P(1 + rt)^3$ |

Teacher: For Year 4, what will the amount be?

Student: $A = P(1 + rt)^4$

Teacher: For 5 years (Year 5), what will it be?

Student: $A = P(1 + rt)^5$

Teacher: And for $t$ years;

Student: $A = P(1 + rt)^t$

Teacher: That is correct.

Keep in mind that this is a case where the interest is compounded annually: one time per year

Assume the interest is compounded semiannually (two times per year)

What factors in that table will be affected?

Student: The rate will be affected

Teacher: How will it be affected?

Student: For example: a rate of 4% per year implies a rate of 2% every six months

Teacher: Say: the variable: m represents the number of compounding periods per year

Student: The rate will be: $\dfrac{r}{m}$

Teacher: That is correct.

What other factor is affected?

Student: The time

Time of 1 for one year implies time of 2 every six months

Teacher: In terms of the number of compounding periods of year, what will be the formula for

the time?

Student: The time will be: $mt$

Teacher: So, what do you think the formula will be considering the number of compounding

periods per

year?

Student: $A = P\left(1 + \dfrac{r}{m}\right)^{mt}$

Teacher: Correct.

This is known as the Compound Amount Formula

The Compound Amount Formula is:

$A = P\left(1 + \dfrac{r}{m}\right)^{mt} \\[5ex]$

Say someone:

deposited an initial sum of money, $P$

in a financial institution that gives an interest rate of $r\%$,

compounded $m$ times per year;

then, after $t$ years,

the person will earn an amount, $A$

OR

Say someone:

borrowed an initial sum of money, $P$

from a financial institution that charges an interest rate of $r\%$,

compounded $m$ times per year;

then, after $t$ years,

the person will pay back an amount, $A$

Student: Is there any case when the simple interest will be equal to the compound interest?

Teacher: Yes...

What do you suggest?

Student: If you have the same principal, for example $\$$1000

the same interest rate, for example 10%

the time must be 1 year

then, the simple interest will be the same as the compound interest compounded annually

I've done the calculation with some numbers.

But, I appreciate if you can do it without numbers.

I'm trying to be very comfortablw with Algebra

Teacher: Sure... let's do it.

When Simple Interest Equals Compound Interest

The principal must be the same

The interest rate must be the same

The time must be one year.

The interest must be compounded annually (for the case of the compound interest)

$

\underline{Simple Interest} \\[3ex]

SI = Prt \\[3ex]

t = 1 \\[3ex]

SI = P * r * 1 \\[3ex]

SI = Pr \\[5ex]

\underline{Compound\;\;Interest} \\[3ex]

compounded\;\;annually \implies m = 1 \\[3ex]

t = 1 \\[3ex]

A = P\left(1 + \dfrac{r}{m}\right)^{mt} \\[5ex]

A = P\left(1 + \dfrac{r}{1}\right)^{1 * 1} \\[5ex]

A = P(1 + r)^1 \\[3ex]

A = P(1 + r) \\[3ex]

CI = A - P \\[3ex]

CI = P(1 + r) - P \\[3ex]

CI = P + Pr - P \\[3ex]

CI = Pr \\[3ex]

$

Please write all the formulas that you see under Compound Interest and let us

solve some examples

The total return on an investment is the relative change in the value of the investment.

It shows the percentage change as the value of the investment changes.

Assume an investment grows an initial principal, P to an amount A.

The total return is the percentage change in the investment value.

The annual return on an investment is the annual percentage yield (APY) that would give the same overall

growth over t years.

NOTE: Unless instructed otherwise;

For all financial calculations, do not round until the final answer.

Do not round intermediate calculations. If it is too long, write it to at least 5 decimal

places (5 or more decimal places).

Round your final answer to 2 decimal places.

Make sure you include the unit.

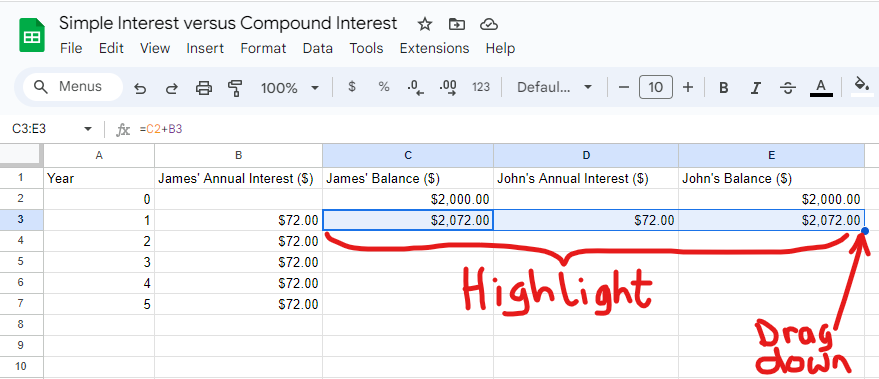

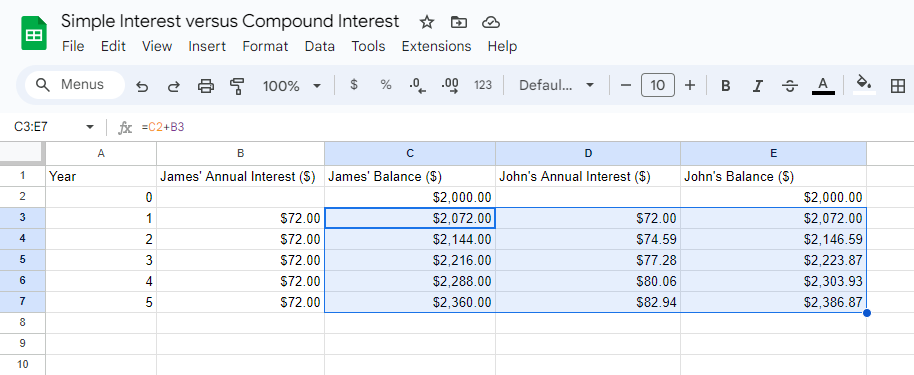

Compare Simple Interest and Compound Interest Using Google Spreadsheet

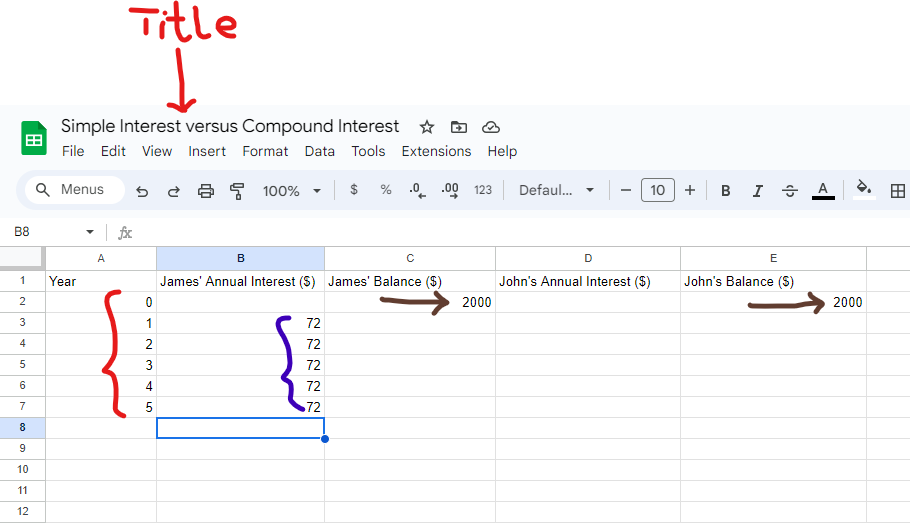

Example 1: James deposits $2000 in an account that earns simple interest at an

annual rate of 3.6%.

John deposits $2000 in an account that earns compound interest at an annual rate of 3.6%

and is

compounded annually.

Complete the table that compares the interests and amounts when the rate is given at a simple interest

rate and when

the rate is compounded once per year, for 5 years.

Solution:

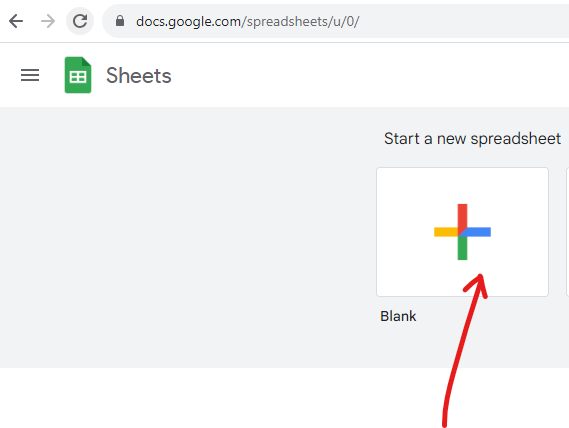

(1.) Visit Google Spreadsheets: https://spreadsheets.google.com/

(2.) Begin a new spreadsheet

(3.) Write the title

In this example, I shall write: Simple Interest versus Compound Interest

(4.) Given:

Simple Interest

Principal, P = $2000

Interest rate, r = 3.6% = 0.036

Time, t = Years = 1, 2, 3, 4, 5

Calculate:

Simple Interest

Amount

$

SI = P * r * t \\[3ex]

SI = 2000 * 0.036 * t \\[3ex]

SI = 72t \\[5ex]

$

Because the simple interest is the same for each year (per year):

$

SI = 72(1) \\[3ex]

SI = \$72 \\[3ex]

$

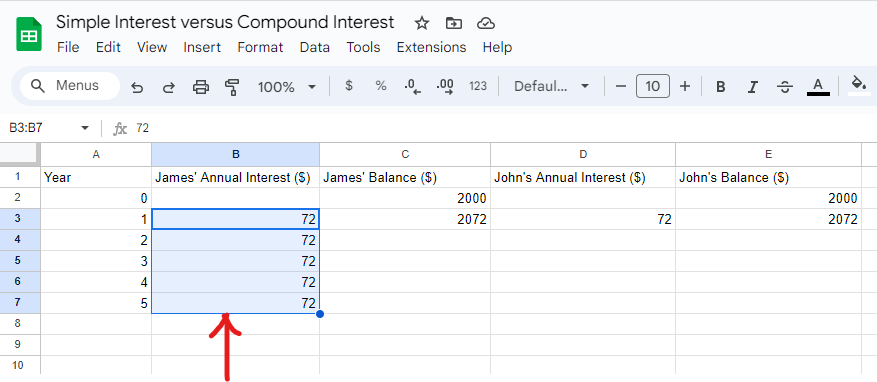

Let us go ahead and write the years and the simple interests for 5 years.

Notice the cells in columns A and B

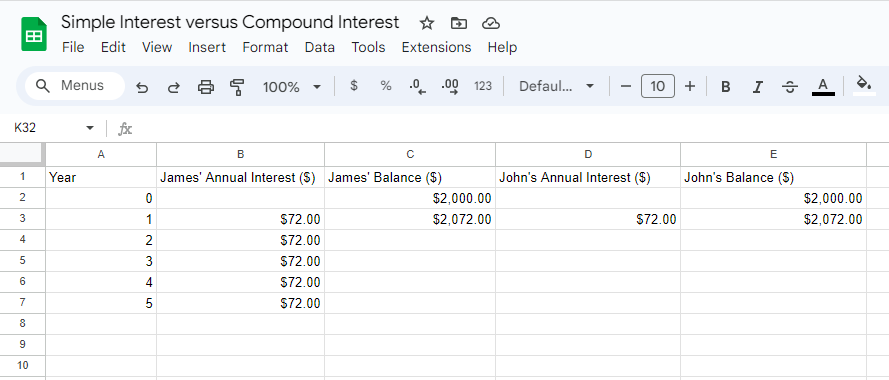

Also, notice the balances in Year 0 for James and John.

This is because that the Principal: the initial amount deposited by each of them.

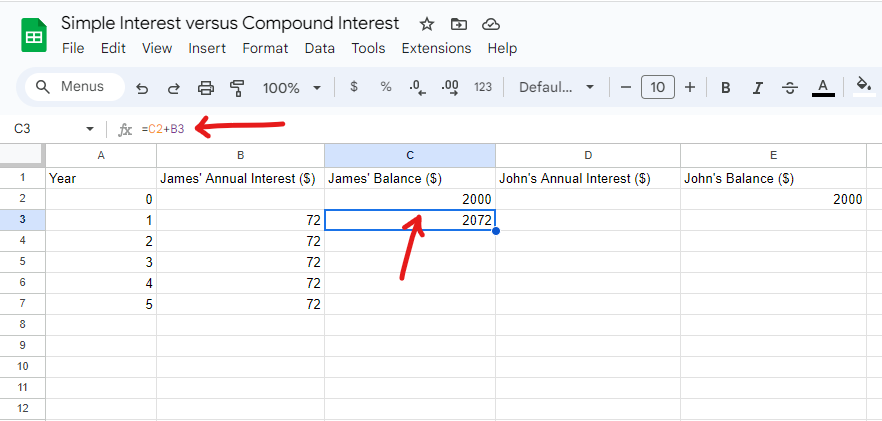

Let us write the formula that computes the amount (balance) at simple interest.

This is James' balance.

$

A = P + SI \\[3ex]

$

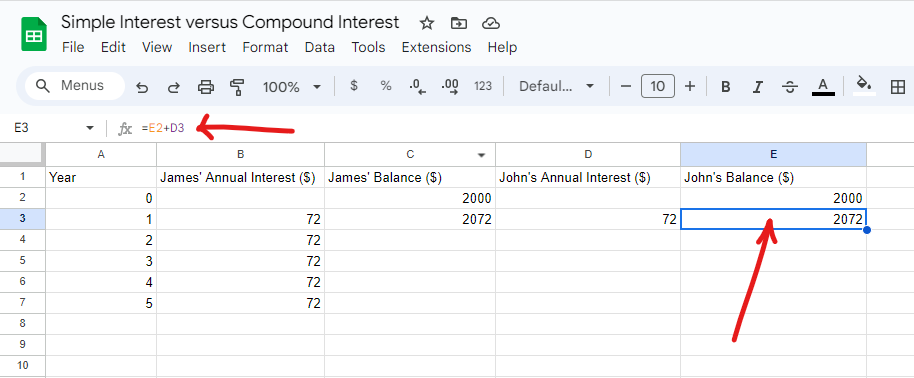

Notice the formula in C3

$

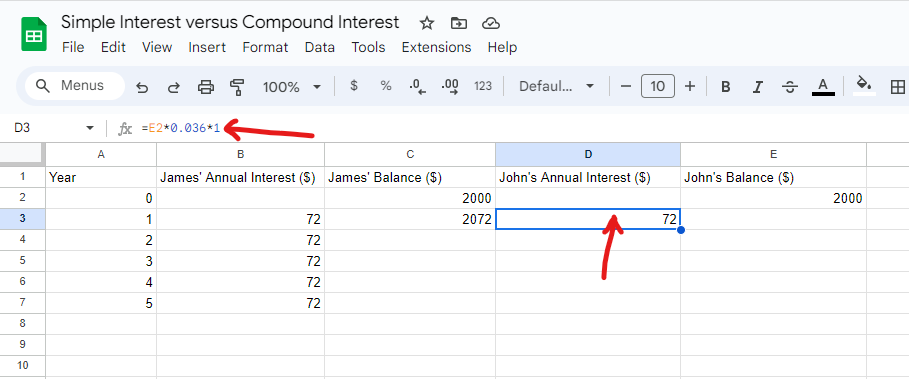

Compound Interest

Principal, P = $2000

Interest rate, r = 3.6% = 0.036

Time, t = Years = 1, 2, 3, 4, 5 but we shall do for each year so the time will be 1 year each year.

Compounded annually ⇒ m = 1

Calculate:

Compound Interest

Let us recall that:

For Compound Interest:

For the 1st year: the compound interest is the same as the simple interest.

For subsequent years, we have to compound the interest per year by using the Simple Interest Formula but

with

different values of the Principal.

The balance at the end of the 1st year is the principal at the beginning of the 2nd year

The balance at the end of the 2nd year is the principal at the beginning of the 3rd year

The balance at the end of the 3rd year is the principal at the beginning of the 4th year

and so on and so forth...

$

1st\;\;year: \\[3ex]

CI = SI \\[3ex]

$

Notice the formula in D3

Next is the Compound Amount

$

A = P + CI \\[3ex]

$

Notice the formula in E3

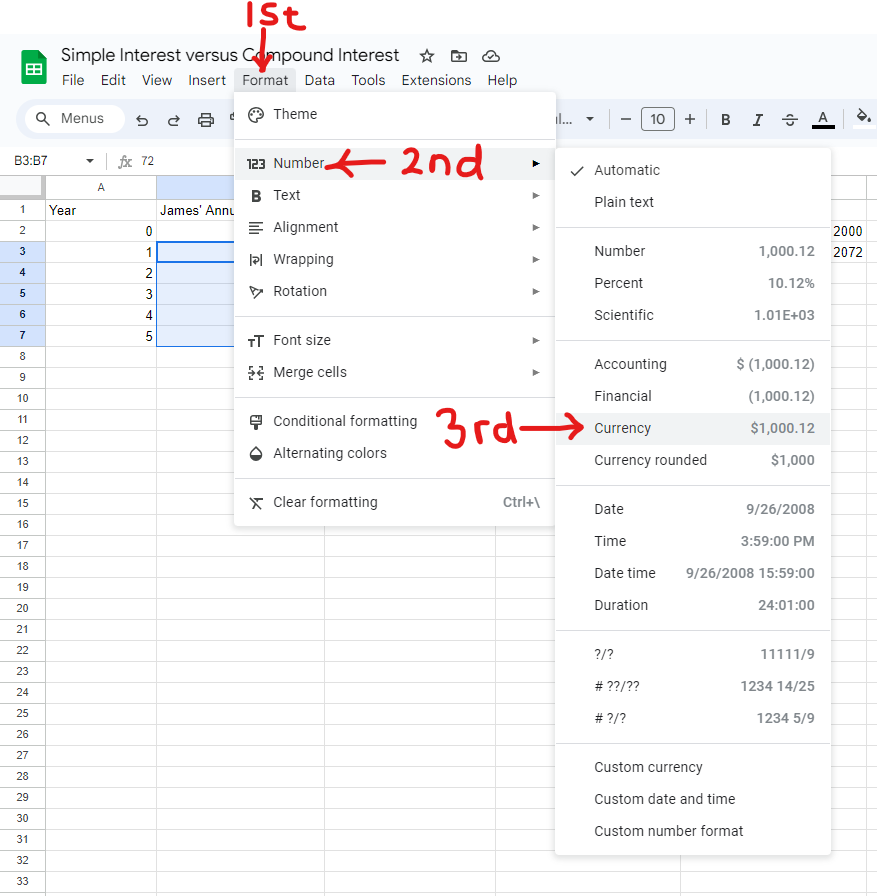

Let us format all currency to two decimal places.

This gives us the apprximate values (not exact values).

To find exact values, please do not format the currencies.

Highlight the cells (with values) to format and click Format menu, then →

Number then → Currency

Let us begin with James' Annual Interest.

Then format it.

Format the rest of the cells as applicable.

We now want to get all the values for the remaining cells.

Highlight the applicable cells and then move to the lower right corner of the last cell and pull/drag

the shaded circle down.

Begin to pull when you see a cross.

Keep pulling/dragging until you get all the values for 5 years.

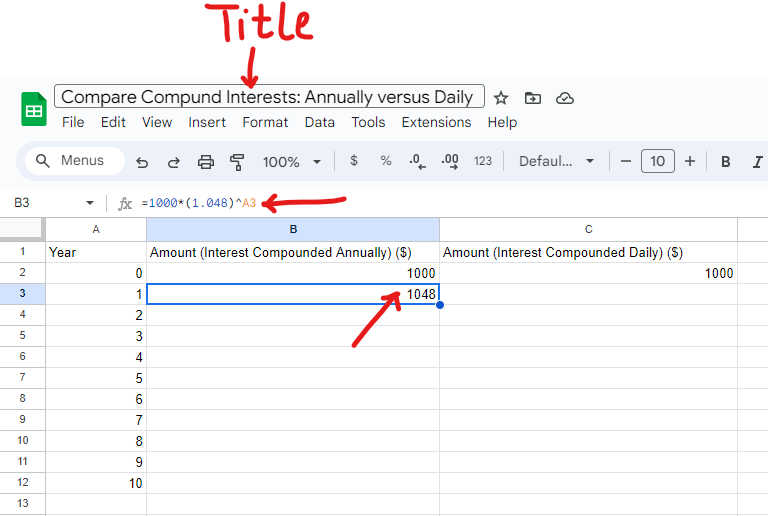

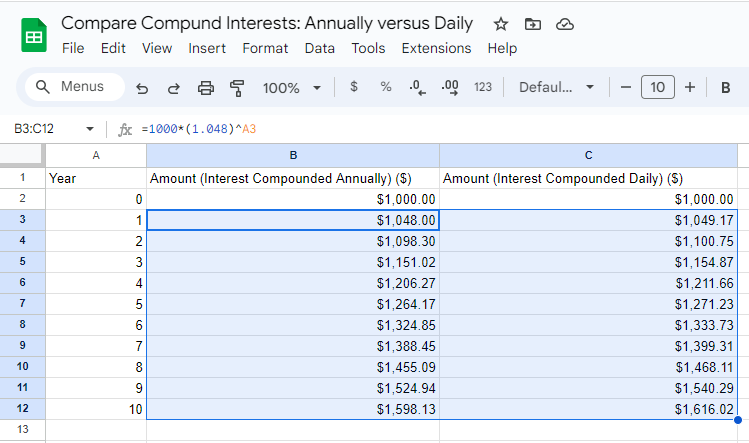

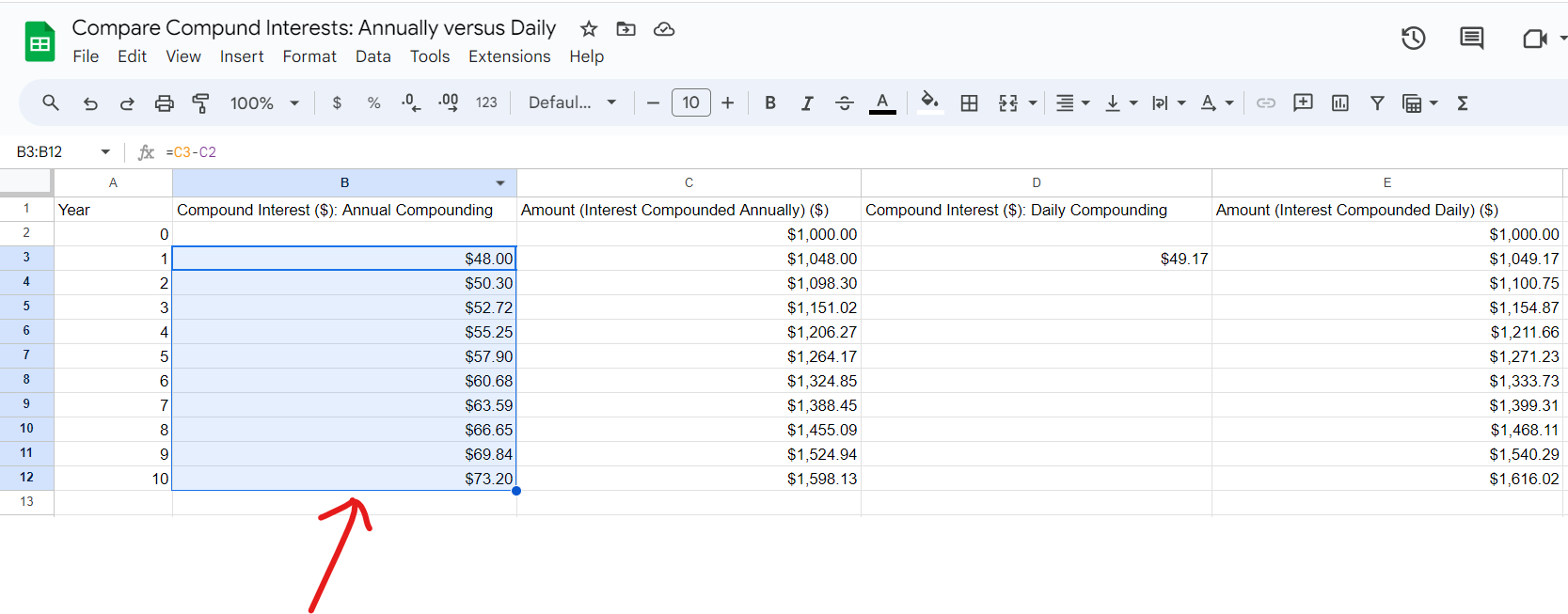

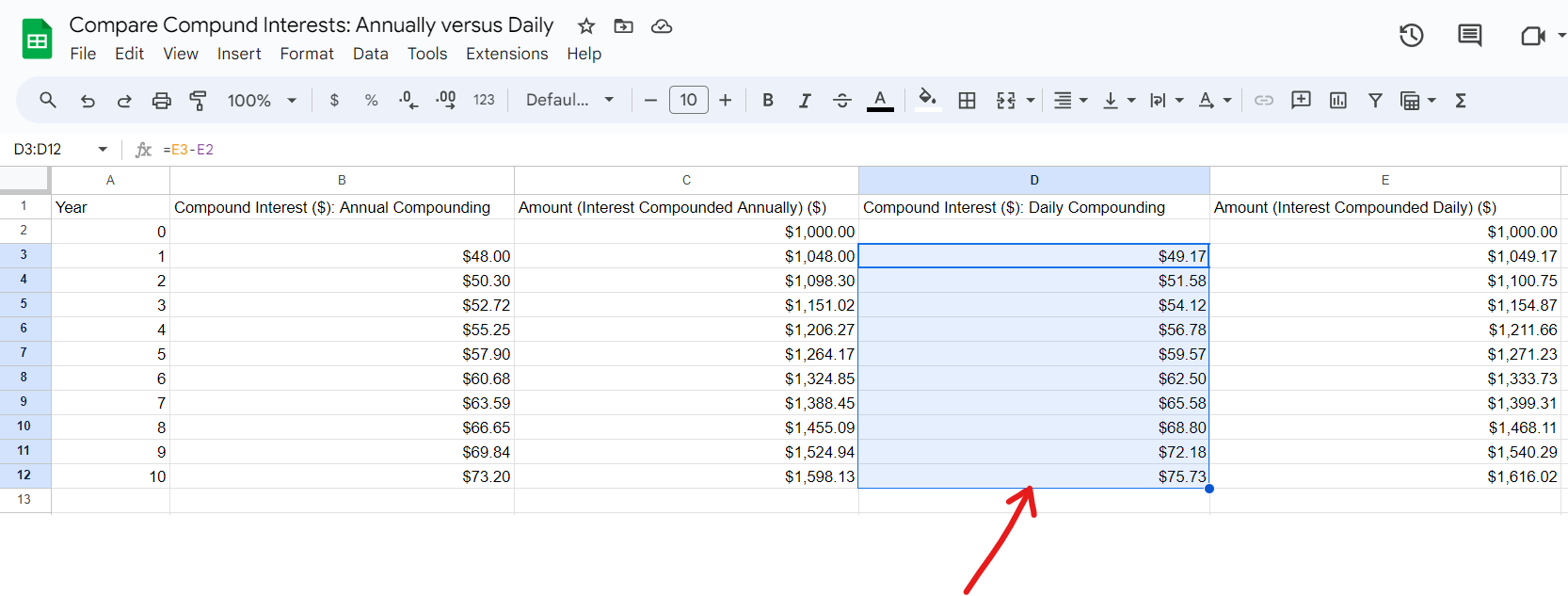

Compare Compound Interest with Different Compounding Periods Using Google Spreadsheet

Example 1: Compare the accumulated balance in two accounts that both start with an initial

deposit of $1000.

Both accounts have an APR of 4.8%, but one account compounds interest annually while the other account

compounds interest daily.

Make a table that shows the accumulated balance in both accounts for the first 10 years.

Solution:

(1.) Visit Google Spreadsheets: https://spreadsheets.google.com/

(2.) Begin a new spreadsheet

(3.) Write the title

In this example, I shall write: Compare Compound Interests: Annually versus Daily

(4.) Given:

Principal, P = $1000

Interest rate, r = 4.8% = 0.048

Compounded Annually → m = 1

Compounded Daily → m = 365

Time, t = Years = 1, 2, 3, 4, 5, 6, 7, 8, 9, 10

Calculate:

Amount

$

A = P\left(1 + \dfrac{r}{m}\right)^{mt} \\[5ex]

\underline{Compounded\;\;Annually} \\[3ex]

A = 1000\left(1 + \dfrac{0.048}{1}\right)^{1 * t} \\[5ex]

A = 1000(1 + 0.048)^t \\[4ex]

A = 1000(1.048)^t \\[5ex]

\underline{Compounded\;\;Daily} \\[3ex]

A = 1000\left(1 + \dfrac{0.048}{365}\right)^{365 * t} \\[5ex]

A = 1000(1 + 0.0001315068493)^{365t} \\[4ex]

A = 1000(1.000131507)^{365t} \\[5ex]

$

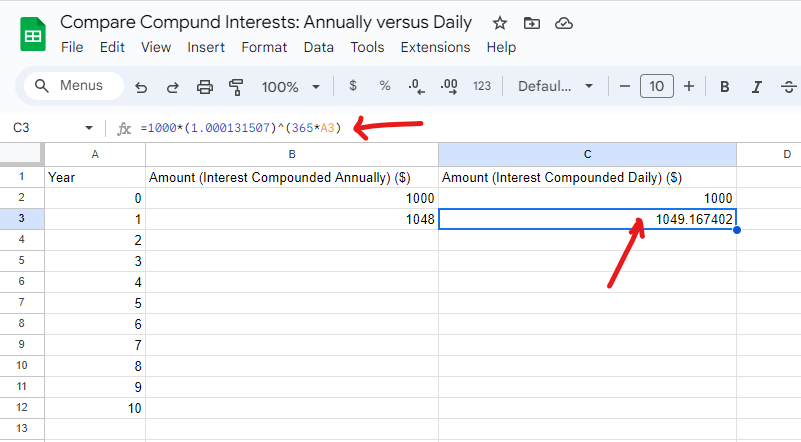

Let us go ahead and write the formula for calculating the amount for interest compounded annually.

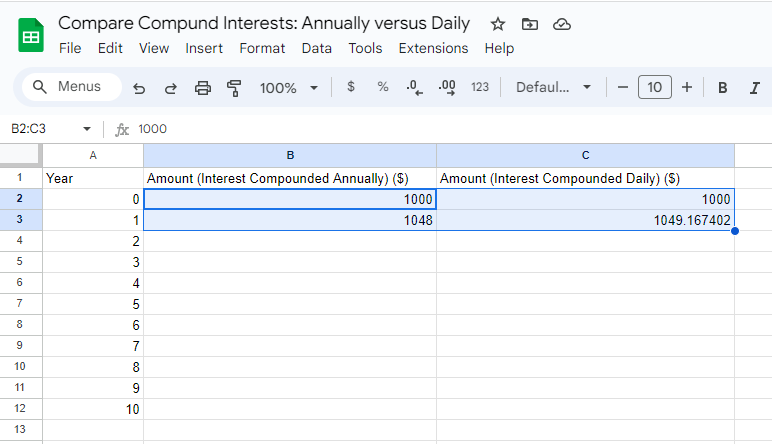

Notice the balance in Year 0: in cells B2 C2

This is because it is the Principal: the initial amount deposited in both accounts.

Notice the formula in cell B3

Let us write the formula for calculating the amount for interest compounded daily.

Notice the formula in cell C3

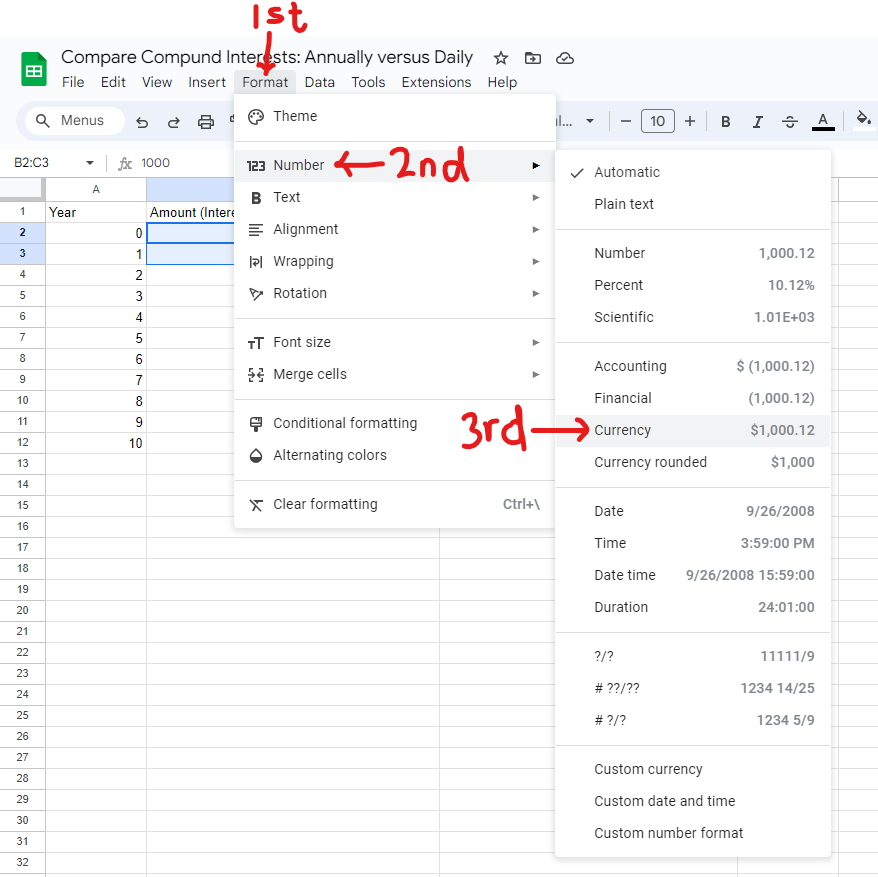

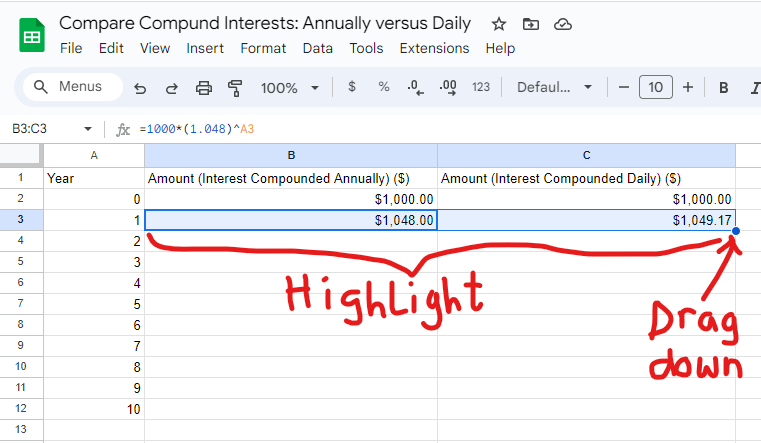

Let us format all currency to two decimal places.

Highlight the applicable cells that we want to format.

Click Format menu, then → Number then → Currency to format

the cells.

We now want to get all the values for the remaining cells.

Highlight the applicable cells and then move to the lower right corner of the last cell and pull/drag

the shaded circle down.

Begin to pull when you see a cross.

Keep pulling/dragging until you get all the values for 10 years.

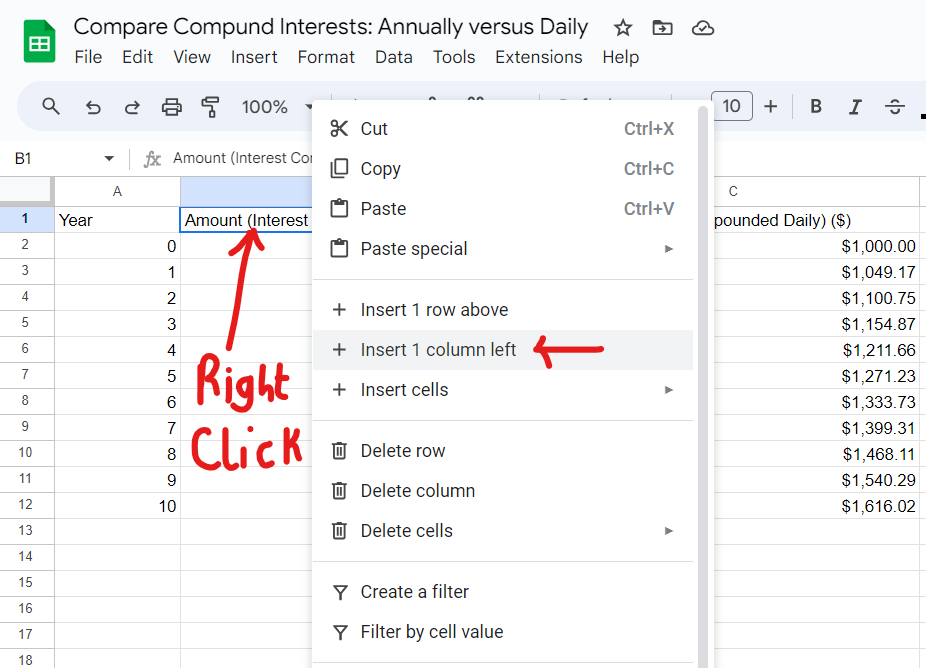

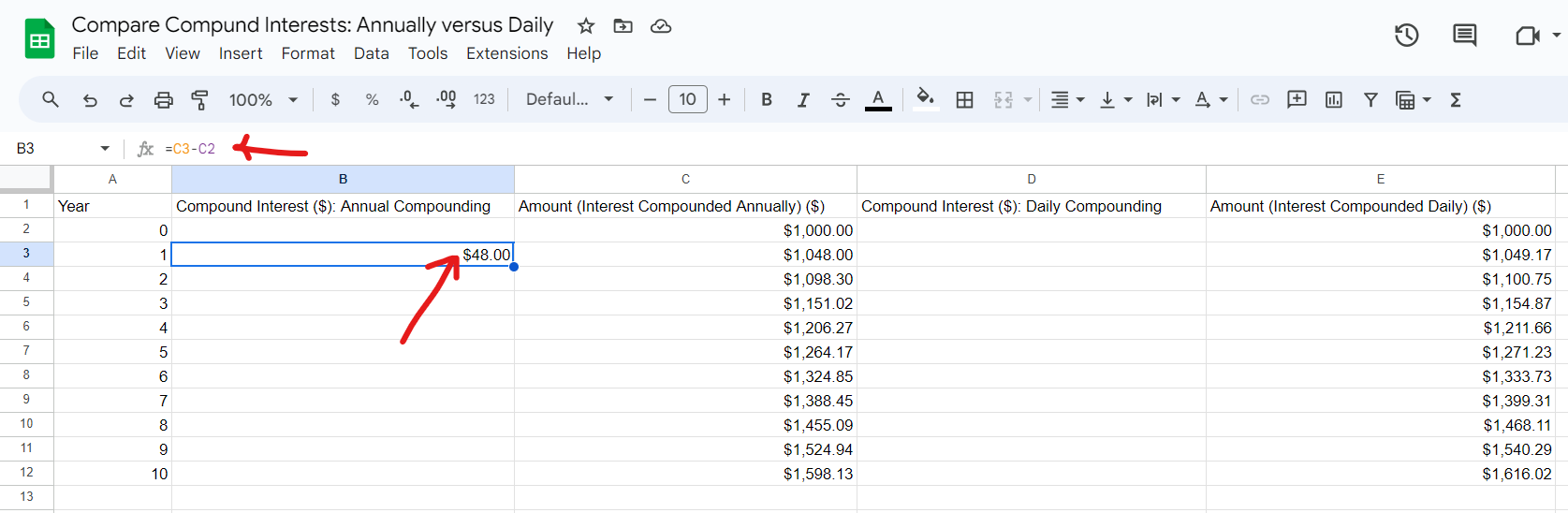

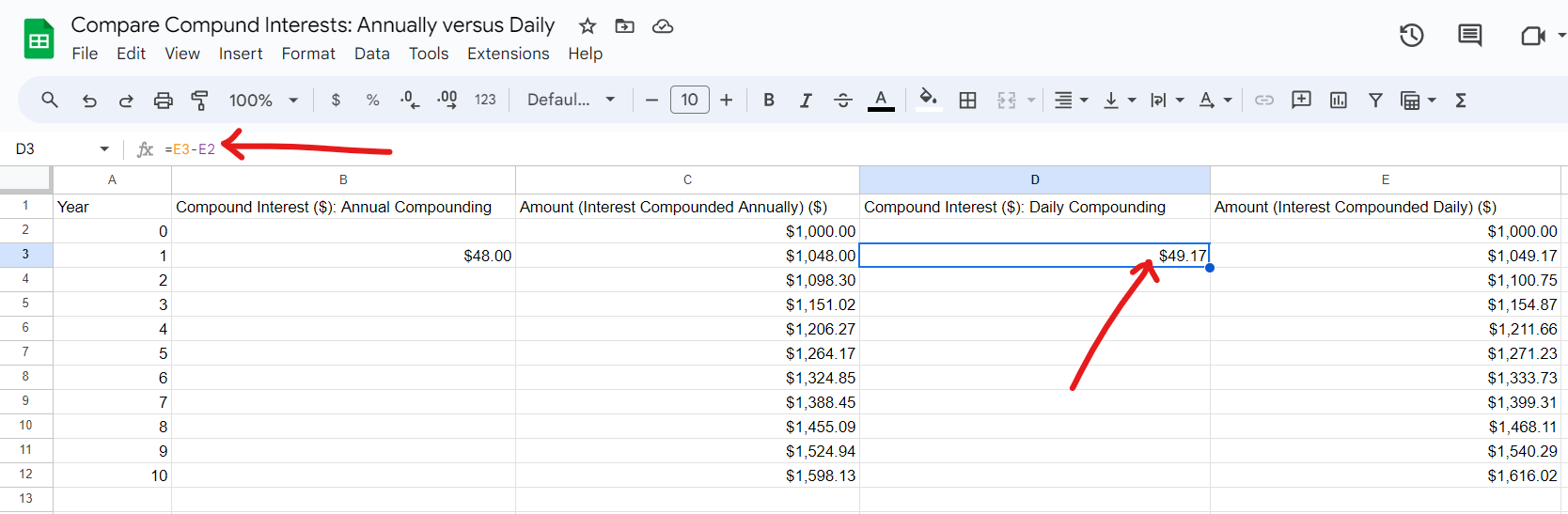

Example 2: Based on Example 1:

Include the interest earned in both accounts for the first 10 years.

Solution:

Right-click and add two columns: one column before the First Amount and one column before the Second

Amount.

Using the computing power of spreadsheets rather than formulas:

The compound interest at the end of Year 1 is the difference between the amount at the end of Year 1 and

the initial amount (the principal)

The compound interest at the end Year 2 is the difference between the amount at the end of Year 2 and

the amount at the end of Year 1

The compound interest at the end Year 3 is the difference between the amount at the end of Year 3 and

the amount at the end of Year 2

...and so on and do forth.

For Annual Compounding of Interest: Let us write the formula for computing the compound interest at the

end of Year 1

Notice the formula in cell B3

For Daily Compounding of Interest: Let us write the formula for computing the compound interest at the

end of Year 1

Notice the formula in cell D3

We now want to get all the values for the remaining cells.

Highlight the applicable cells and then move to the lower right corner of the last cell and pull/drag

the shaded circle down.

Begin to pull when you see a cross.

Compute the compound interest for annual compounding.

Compute the compound interest for daily compounding.

Continuous Compound Interest

Teacher: Now, we can get to your question.

Student: Yes...

I would like to know if there is a limit to how much money one can earn.

I mean...who would want his/her money to be compounded annually when he/she makes more money

when the same amount of money is compounded semiannually?

Say you deposit $\$1$ in a financial institution that has an annual interest rate of $100\%$ for $1$

year.

Let us calculate the Amount for several options of times: annually, semiannually, quarterly,

monthly, weekly, ordinary-daily, exact-daily, and several times per year.

We want to see how much you would get for each option of time for that same principal of

$1 for that same time of 1 year.

Recall the Compound Amount Formula:

$

A = P\left(1 + \dfrac{r}{m}\right)^{mt} \\[5ex]

P = \$1 \\[3ex]

r = 100\% = \dfrac{100}{100} = 1 \\[5ex]

t = 1\:\: year \\[3ex]

$

Let us calculate and observe. 😊

| Compounded: | m | A |

|---|---|---|

| Annually | 1 | $$ A = 1 * \left(1 + \dfrac{1}{1}\right)^{1 * 1} \\[5ex] A = 1(1 + 1)^1 \\[3ex] A = 1(2)^1 \\[3ex] A = 1(2) \\[3ex] A = \$2.00 $$ |

| Semiannually | 2 | $$ A = 1 * \left(1 + \dfrac{1}{2}\right)^{2 * 1} \\[5ex] A = 1(1 + 0.5)^2 \\[3ex] A = 1(1.5)^2 \\[3ex] A = 1(2.25) \\[3ex] A = \$2.25 $$ |

| Quarterly | 4 | $$ A = 1 * \left(1 + \dfrac{1}{4}\right)^{4 * 1} \\[5ex] A = 1(1 + 0.25)^4 \\[3ex] A = 1(1.25)^4 \\[3ex] A = 1(2.44140625) \\[3ex] A = \$2.44 $$ |

| Monthly | 12 | $$ A = 1 * \left(1 + \dfrac{1}{12}\right)^{12 * 1} \\[5ex] A = 1(1 + 0.0833333333)^{12} \\[3ex] A = 1(1.0833333333)^{12} \\[3ex] A = 1(2.61303529) \\[3ex] A = \$2.61 $$ |

| Weekly | 52 | $$ A = 1 * \left(1 + \dfrac{1}{52}\right)^{52 * 1} \\[5ex] A = 1(1 + 0.0192307692)^{52} \\[3ex] A = 1(1.019230769)^{52} \\[3ex] A = 1(2.692596954) \\[3ex] A = \$2.69 $$ |

| Daily - Ordinary | 360 | $$ A = 1 * \left(1 + \dfrac{1}{360}\right)^{360 * 1} \\[5ex] A = 1(1 + 0.0027777778)^{360} \\[3ex] A = 1(1.002777778)^{360} \\[3ex] A = 1(2.714516025) \\[3ex] A = \$2.71 $$ |

| Daily - Exact | 365 | $$ A = 1 * \left(1 + \dfrac{1}{365}\right)^{365 * 1} \\[5ex] A = 1(1 + 0.002739726)^{365} \\[3ex] A = 1(1.002739726)^{365} \\[3ex] A = 1(2.714567482) \\[3ex] A = \$2.71 $$ |

| 500 times per year | 500 | $$ A = 1 * \left(1 + \dfrac{1}{500}\right)^{500 * 1} \\[5ex] A = 1(1 + 0.002)^{500} \\[3ex] A = 1(1.002)^{500} \\[3ex] A = 1(2.715568521) \\[3ex] A = \$2.72 $$ |

| 1,000 times per year | 1,000 | $$ A = 1 * \left(1 + \dfrac{1}{1000}\right)^{1000 * 1} \\[5ex] A = 1(1 + 0.001)^{1000} \\[3ex] A = 1(1.001)^{1000} \\[3ex] A = 1(2.716923932) \\[3ex] A = \$2.72 $$ |

| 10,000 times per year | 10,000 | $$ A = 1 * \left(1 + \dfrac{1}{10000}\right)^{10000 * 1} \\[5ex] A = 1(1 + 0.0001)^{10000} \\[3ex] A = 1(1.0001)^{10000} \\[3ex] A = 1(2.718145927) \\[3ex] A = \$2.72 $$ |

| 100,000 times per year | 100,000 | $$ A = 1 * \left(1 + \dfrac{1}{100000}\right)^{100000 * 1} \\[5ex] A = 1(1 + 0.00001)^{100000} \\[3ex] A = 1(1.00001)^{100000} \\[3ex] A = 1(2.718268237) \\[3ex] A = \$2.72 $$ |

| 1,000,000 times per year | 1,000,000 | $$ A = 1 * \left(1 + \dfrac{1}{1000000}\right)^{1000000 * 1} \\[5ex] A = 1(1 + 0.000001)^{1000000} \\[3ex] A = 1(1.000001)^{1000000} \\[3ex] A = 1(2.718280469) \\[3ex] A = \$2.72 $$ |

| 10,000,000 times per year | 10,000,000 | $$ A = 1 * \left(1 + \dfrac{1}{10000000}\right)^{10000000 * 1} \\[5ex] A = 1(1 + 0.0000001)^{10000000} \\[3ex] A = 1(1.0000001)^{10000000} \\[3ex] A = 1(2.718281693) \\[3ex] A = \$2.72 $$ |

Teacher: Did you notice anything?

Student: THANK GOD for cents (2 decimal places)

Teacher: Exactly!

Imagine if money was not rounded to 2 decimal places

Student: It would continue...and...continue...and...continue...

Teacher: That is right.

What did you notice?

Student: The final amount is $\$2.72$

Would it continue that way even if you compound it a trillion times per year?

Teacher: Yes, it would still give an amount of $\$2.72$

So, no matter how many times you compound $\$1$ in $1$ year,

Student: The amount at the end of $1$ year would be $\$2.72$

Teacher: and the compound interest would be ...

Student: $2.72 - 1.00 = \$1.72$

Teacher: Correct!

Did you notice any constant in the last four that we did: from $m = 10,000$ up to to $m =

10,000,000$?

Student: Yes, the first four digits is: 2.718

Observation:

The amount from when we compounded $\$1$ (a dollar), $10,000$ (ten thousand) times up to when we

compounded it $10,000,000$ (ten million) times in $1$ year, the first four digits were constant.

The amount was approximately $2.718$

This constant is known as the Euler number, by Leonhard Euler (a Swiss mathematician) OR

Napier's constant, John Napier (a Scottish/English mathematician).

Teacher: To be honest, any one of you could have discovered this constant.

You have learned what they discovered.

Now, think and work towards discovering your own.

Let me show you this constant in your calculator.

The constant is denoted by $e$

$e \approx 2.718$

The logarithm to base, $e$ is known as Natural Logarithm or Napierian Logarithm

The logarithm to base $e$ of $x$ is written as: $\log_e{x}$ or $\ln{x}$

Write down all the formulas that you see under Continuous Compound Interest and let us

solve some examples

The total return on an investment is the relative change in the value of the investment.

It shows the percentage change as the value of the investment changes.

Assume an investment grows an initial princial, P to an amount A.

The total return is the percentage change in the investment value.

The annual return on an investment is the annual percentage yield (APY) that would give the same

overall growth over Y years.

NOTE: Unless instructed otherwise;

For all financial calculations, do not round until the final answer.

Do not round intermediate calculations. If it is too long, write it to at least 5 decimal

places (5 or more decimal places).

Round your final answer to 2 decimal places.

Make sure you include the unit.

Annual Percentage Yield

Teacher: Everyone would want a compounded interest rate. Right?

Student: To be honest, I would want a continuous compounded interest rate.

Teacher: That is right. It is still compounded though 😊

So, how do we solve this problem?

Would there be any need for simple interest rate?

Student: I guess not.

Teacher: So, how about finding a simple interest rate that would give the same compound

amount in one year as if we used the compound interest compounded annually?

Student: May you please elaborate?

Teacher: Let us review this example:

Say Mr. C deposits $\$1000$ in a financial institution that gives an interest rate of $7\%$.

How much will be in his account after $1$ year?

Student:

$

P = \$1000 \\[3ex]

r = 7\% = 0.07 \\[3ex]

t = 1\:year \\[3ex]

SI = 1000(0.07)(1) = \$70 \\[3ex]

A = 1000 + 70 = \$1070 \\[3ex]

Mr.\:C\:\:will\:\:have\:\:\$1070\:\:after\:\:1\:year \\[3ex]

$

Teacher: That is correct!

Say Mr. C deposits $\$1000$ in a financial institution that gives an interest rate of $7\%$.

How much will be in his account after $1$ year if the interest rate is compounded annually?

Student:

$

P = \$1000 \\[3ex]

r = 7\% = 0.07 \\[3ex]

t = 1\:year \\[3ex]

m = 1...compounded\:\:annually \\[3ex]

A = P\left(1 + \dfrac{r}{m}\right)^{mt} \\[5ex]

mt = 1(1) = 1 \\[3ex]

\dfrac{r}{1} = \dfrac{0.07}{1} = 0.07 \\[5ex]

A = 1000(1 + 0.07)^1 \\[5ex]

A = 1000(1.07)^1 \\[3ex]

A = 1000(1.07) \\[3ex]

A = \$1070 \\[3ex]

Mr.\:C\:\:will\:\:have\:\:\$1070\:\:after\:\:1\:year \\[3ex]

It\:\:is\:\:the\:\:same\:\:amount\:\:after\:\:1\:\:year \\[3ex]

$

Teacher: That is correct!

Teacher: So, the question is this.

Can we find a simple interest rate that will give $\$1070$ in one year?

In other words, can we find a simple interest rate that will give that compound amount of

$\$1070$ in one year?

Student: Well, we did already.

That simple interest rate of $7\%$ gave the same amount of $\$1070$ after one year.

Teacher: That is correct... in this case.

The simple interest rate that will give the same compound amount after one year is known as the

Annual Percentage Yield for Compound Interest

Annual Percentage Yield is also known as APY

Student: Do we have the Annual Percentage Yield for Continuous Compound Interest as well?

Teacher: Yes, we do!

How would you define it?

Student: I guess it will be the simple interest rate that will give the same continuous

compound amount after one year.

Teacher: Correct!

Let us find out.

Say Mr. C deposits $\$1000$ in a financial institution that gives an interest rate of $7\%$.

How much will be in his account after $1$ year if the interest rate is continously compounded?

Student:

$

P = \$1000 \\[3ex]

r = 7\% = 0.07 \\[3ex]

t = 1\:year \\[3ex]

A = Pe^{rt} \\[3ex]

rt = 0.07(1) = 0.07 \\[3ex]

A = 1000 * e^{0.07} \\[5ex]

A = 1000(1.07250818) \\[3ex]

A = 1072.50818 \\[3ex]

A \approx \$1072.51 \\[3ex]

Mr.\:C\:\:will\:\:have\:\:\$1072.51\:\:after\:\:1\:year \\[3ex]

$

Teacher: That is correct!

The simple interest rate of $7\%$ will not work this time.

This means that it is not the APY for the Continuous Compound Interest

Student: How do we find that APY?

Just to be sure, how do we find the simple interest rate that will give $\$1072.51$ after one year?

Teacher: Try the simple interest rate of $7.2508\%$

Say Mr. C deposits $\$1000$ in a financial institution that gives an interest rate of $7.2508\%$.

How much will be in his account after $1$ year?

Student:

$

P = \$1000 \\[3ex]

r = 7.2508\% = 0.072508 \\[3ex]

t = 1\:year \\[3ex]

SI = 1000(0.072508)(1) = \$72.08 \\[3ex]

A = 1000 + 72.08 = \$1072.08 \\[3ex]

Mr.\:C\:\:will\:\:have\:\:\$1072.08\:\:after\:\:1\:year \\[3ex]

$

It is almost the same...just a few cents difference

It seems you gave me a rounded value, Sir.

But, you asked not not to round.

Teacher: You are right. It is a rounded value.

You are right. I asked you not to round, if I did not ask you to round. 😊

Here, try this value...the simple interest rate of $7.25081813\%$

Student:

$

P = \$1000 \\[3ex]

r = 7.25081813\% = 0.0725081813 \\[3ex]

t = 1\:year \\[3ex]

SI = 1000(0.0725081813)(1) = \$72.5081813 \\[3ex]

A = 1000 + 72.5081813 = \$1072.50818 \\[3ex]

Mr.\:C\:\:will\:\:have\:\:\$1072.51\:\:after\:\:1\:year \\[3ex]

$

How did you get that rate? This is interesting!

Teacher: Yes it is! Welcome to APY!!!

The Annual Percentage Yield is also known as APY or Effective Interest Rate or

Effective Rate or True Interest Rate

The Annual Percentage Yield for Compound Interest is defined as the simple interest rate

that will yield the same amount as the compound amount after one year.

APR and APY are the same with annual compounding.

However, with more than one compounding per year, the APY is always greater than the APR. It reflects

the cumulative effects of several compoundings during the year.

Thus, the more compoundings during the year, the greater the APY.

It does not depend on the starting principal. It gives the percentage increase in the balance.

Let us derive the formula.

This means that:

Amount at Simple Interest after one year is equal to Amount at Compound Interest after one year.

$

\underline{Simple\:\:Interest} \\[3ex]

A = P(1 + rt) \\[3ex]

After\:\:1\:\:year \rightarrow t = 1\:year \\[3ex]

A = P(1 + r * 1) \\[3ex]

A = P(1 + r) \\[3ex]

\underline{Compound\:\:Interest} \\[3ex]

A = P\left(1 + \dfrac{r}{m}\right)^{mt} \\[5ex]

After\:\:1\:\:year \rightarrow t = 1\:year \\[3ex]

A = P\left(1 + \dfrac{r}{m}\right)^{m * 1} \\[5ex]

A = P\left(1 + \dfrac{r}{m}\right)^{m} \\[5ex]

Equate\:\:both\:\:amounts \\[3ex]

A = A \\[3ex]

P(1 + r) = P\left(1 + \dfrac{r}{m}\right)^{m} \\[5ex]

But\:\:the\:\:r\:\:in\:\:Simple\:\:Interest = APY \\[3ex]

P(1 + APY) = P\left(1 + \dfrac{r}{m}\right)^{m} \\[5ex]

Divide\:\:both\:\:sides\:\:by\:\:P \\[3ex]

1 + APY = \left(1 + \dfrac{r}{m}\right)^{m} \\[5ex]

Subtract\:\:1\:\:from\:\:both\:\:sides \\[3ex]

\therefore APY = \left(1 + \dfrac{r}{m}\right)^{m} - 1 \\[5ex]

This\:\:is\:\:the\:\:APY\:\:for\:\:Compound\:\:Interest

$

The Annual Percentage Yield for Continuous Compound Interest is defined as the simple interest

rate that will

yield the same amount as the continuous compound amount after one year.

Let us derive the formula.

This means that:

Amount at Simple Interest after one year is equal to Amount at Continuous Compound Interest after one

year.

$

\underline{Simple\:\:Interest} \\[3ex]

A = P(1 + rt) \\[3ex]

After\:\:1\:\:year \rightarrow t = 1\:year \\[3ex]

A = P(1 + r * 1) \\[3ex]

A = P(1 + r) \\[3ex]

\underline{Continuous Compound\:\:Interest} \\[3ex]

A = Pe^{rt} \\[3ex]

After\:\:1\:\:year \rightarrow t = 1\:year \\[3ex]

A = Pe^{r * 1} \\[3ex]

A = Pe^r \\[3ex]

Equate\:\:both\:\:amounts \\[3ex]

A = A \\[3ex]

P(1 + r) = Pe^r \\[3ex]

But\:\:the\:\:r\:\:in\:\:Simple\:\:Interest = APY \\[3ex]

P(1 + APY) = e^r \\[3ex]

Divide\:\:both\:\:sides\:\:by\:\:P \\[3ex]

1 + APY = e^r \\[3ex]

Subtract\:\:1\:\:from\:\:both\:\:sides \\[3ex]

\therefore APY = e^r - 1 \\[5ex]

This\:\:is\:\:the\:\:APY\:\:for\:\:Continuous\:\:Compound\:\:Interest

$

Write down all the formulas that you see under Annual Percentage Yield and let us solve some examples

NOTE: Unless instructed otherwise;

For all financial calculations, do not round until the final answer.

Do not round intermediate calculations. If it is too long, write it to at least 5 decimal

places (5 or more decimal places).

Round your final answer to 2 decimal places.

Make sure you include the unit.

Investments for Retirement

The savings plan formula calculates the accumulated savings plan balance as it grows because of the periodic deposits and interest.

It is used as a convenient alternative to making an extensive table of savings plan calculations.

A person with a savings account makes monthly deposits that gain a percentage of interest each month.

The balance increases by the amount deposited each month plus the percent interest of the previous month's balance.

If deposits are continuously made, the amount of interest made each month will increase.

These calculations can be made using the savings plan formula below:

$ FV = m * PMT * \left[\dfrac{\left(1 + \dfrac{r}{m}\right)^{mt} - 1}{r}\right] \\[10ex] $ where:

FV represents accumulated savings plan balance

PMT represents regular payment (deposit) amount

r is the APR. It represents annual percentage rate (as a decimal)

m is the number of payment periods per year

t represents the number of years.

As with compound interest, the accumulated balance (A) is often called the future value (FV); the present value is the starting principal (P), which is 0 because we assume the account has no balance before the payments begin.

The three basic types of investments: Stocks, Bonds, and Cash

You can invest directly, which means buying individual investments yourself (often through a broker).

You can invest indirectly, by purchasing shares in a mutual fund, through which a professional fund manager invests your money along with the money of others participating in the fund.

Stock (or equity) gives you a share of ownership in a company.

A stock is defined as the ownership of a corporation, indicated by shares, and held by an individual or group.

Stocks of public corporations usually have unique one, two, three, or four letter upper case symbols that identify them.

These are called ticker symbols.

Examples include: F (Ford Motor Company), KO (The Coca-Cola Company), XRX (Xerox Corporation), GOOG (Google Inc.), and MSFT (Microsoft Corporation) among others.

You invest by purchasing shares of the stock, and the only way to get your money out is to sell the stock.

Because stock prices change with time, the sale may give you either a gain or a loss on your original investment.

Some of the terms used in Stocks are:

| Term | Meaning |

|---|---|

| Ticker Symbol | The company name and the ticker symbol used to identify it. |

| Now | Price per share, in dollars, at time shown. |

| Shares Outstanding | The total number of shares that exist for the company. |

| Marker Cap | Total stock value of the company. |

| Change | Change in share price, in dollars, since prior day's close. |

| Open/High/Low | Opening, highest, and lowest share prices so far today. |

| Volume | The number of shares that have been traded today. |

| Dividend | The dividend paid during the last quarter, per share. |

A bond (or debt) represents a promise of future cash.

You usually buy bonds issued by either a government or corporation.

The issuer pays you simple interest (as opposed to compound interest) and promises to pay back your initial investment plus interest at some later date.

The face value (or par value) of the bond is the price that must be paid to the issuer to buy it at the time it is issued.

The coupon rate of the bond is the simple interest rate that the issuer promises to pay.

For example, a coupon rate of 7% on a bond with a face value of $1000 means that the issuer will pay interest of 7% * $1000 = $70 each year.

The maturity date of the bond is the date on which the issuer promises to repay the face value of the bond.

Buying a bond at a premium means paying a price that is greater than the bond's face value.

Buying a bond at a discount means paying a price that is less than the bond's face value.

The current yield of a bond is defined as the amount of interest it pays each year divided by the bond's current price (not its face value).

Cash investments include money you deposit into bank accounts, certificates of deposit (CD), and U.S. treasury bills.

Cash investments generally earn interest.

An investment's liquidity is how easily money can be withdrawn from an investment.

An investment from which money can be withdrawn easily, such as an ordinary bank account, is said to be liquid.

The liquidity of an investment like real estate is much lower because real estate can be difficult to sell.

An investment's risk is the chance of losing the principal invested.

The safest investments are federally insured bank accounts and U.S. Treasury bills; there's virtually no risk of losing the principal invested.

Stocks and bonds are much riskier because they can drop in value, in which case part or all of the principal could be lost.

An investment's return is the total or annual amount of money that is expected to be earned on an investment.

A higher return means that more money is earned.

In general, low-risk investments offer relatively low returns, while high-risk investments offer the prospects of higher returns, along with the possibility of losing the principal.

Balancing risk and return is of the most difficult tasks of investing.

Risking too much might lose someone money, and risking too little may result in little to no return.

One of the most difficult tasks of investing is trying to balance risk and return.

Although there is no way to predict the future, historical trends offer at least some guidance.

Contrasting the three basic types of investments:

Stocks have historically proven to be a far better long-term investment than bonds or cash, but can do poorly over shorter time periods.

Cash has the lowest return rate.

There's also no guarantee that stocks will continue to outperform other investments in the future.

To study historical trends, financial analysts generally look at an index that describes the overall performance of some category of investment.

The best-known index is the Dow Jones Industrial Average (DJIA), which reflects the average prices of the stocks of 30 large companies.

The 30 companies are chosen by the editors of the Wall Street Journal.

Financial indexes, such as the Dow Jones Industrial Average (DJIA), help keep track of historical returns by reflecting the average prices of the stocks of 30 large companies chosen by the editors of the Wall Street Journal.

A Mutual Fund is a fund operated by an investment company that accepts money from investors and invests it on their behalf in stocks and bonds among others.

Some of the terms used in Mutual Funds are:

| Term | Meaning |

|---|---|

| Fund Name | The full name of the mutual fund. |

| Symbol | The "ticker symbol" for the fund. |

| NAV | The net asset value is essentially the share price: that is the current value, in dollars, of each share in the fund. |

| YTD% Return | The total return on the fund's shares year-to-date (since Jan. 1). |

| 1-Yr 3-Yr 5-Yr 10-Yr | The average annual return on the fund's shares for the periods indicated. |

A corporation is a legal entity created and authorized to operate under the laws of a state for the purpose of conducting business.

Write down all the formulas that you see under Investment for Retirement and

let us

solve some examples: Part

1

and

solve some examples: Part

2

NOTE: Unless instructed otherwise;

For all financial calculations, do not round until the final answer.

Do not round intermediate calculations. If it is too long, write it to at least 5 decimal

places (5 or more decimal places).

Round your final answer to 2 decimal places.

Make sure you include the unit.

Future Value of Ordinary Annuity and Sinking Fund

An annuity is defined as a sequence of equal periodic payments.

If the payments are made at the end of each period, it is known as an ordinary annuity

If the payments are made at the beginning of each period, it is known as an annuity due

An Ordinary Annuity is a sequence of equal periodic payments in which each payment is

made at the end of each period.

The periods could be yearly, monthly (most common), biweekly (also common), and weekly among others.

The Future Value of an Ordinary Annuity is the sum of all the periodic payments and

all the earned interests.

Applications of the Future Value of an Ordinary Annuity are seen in: college savings accounts, IRAs

(Individual Retirement Accounts), 401(k), 403(b), and other investments that

require periodic payments.

For example: If someone is contributing a certain percentage of his salary or a certain amount of

his salary every month to a 401(k) investment account, how much would the

person have when he retires at a certain age, or when he stops contributing after some time?

Write down all the formulas that you see under Future Value of Ordinary Annuity and Sinking Fund and let us solve some examples

NOTE: Unless instructed otherwise;

For all financial calculations, do not round until the final answer.

Do not round intermediate calculations. If it is too long, write it to at least 5 decimal

places (5 or more decimal places).

Round your final answer to 2 decimal places.

Make sure you include the unit.

Present Value of Ordinary Annuity and Amortization

An installment loan is a loan or money that is borrowed and agreed to be

paid back in installments.

Typically, equal periodic payments are made over the term of the loan (duration of the loan).

The periodic payments could be weekly payments, bi-weekly payments, monthly payments, or some other

periodic payments as the case may be.

Installment loans allow consumers to finance high price purchases of some things that they would

otherwise not be able to afford immediately. These include cars and homes among others.

Amortization is defined as the repayment of a loan by installments.

In the United States, most installment loans are based on monthly payments, and the interest on those

loans is compounded on a monthly basis.

Write down all the formulas that you see under Amortization and the Present Value of Ordinary Annuity and let us solve some examples

NOTE: Unless instructed otherwise;

For all financial calculations, do not round until the final answer.

Do not round intermediate calculations. If it is too long, write it to at least 5 decimal

places (5 or more decimal places).

Round your final answer to 2 decimal places.

Make sure you include the unit.

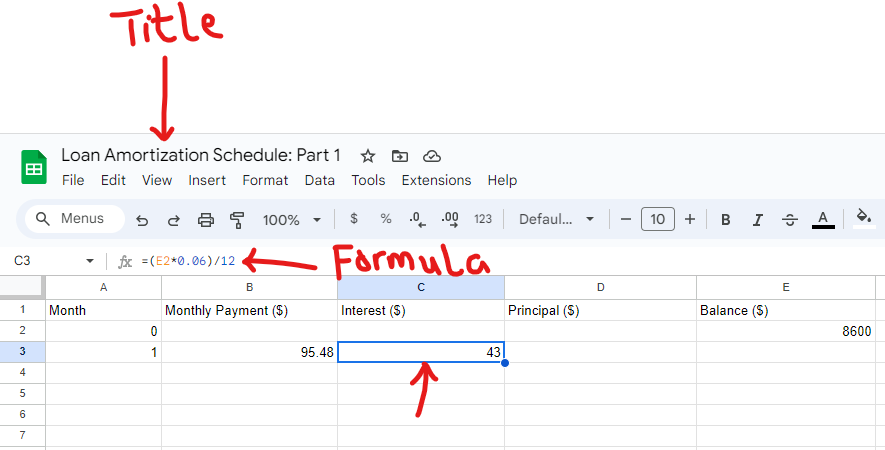

Prepare a Loan Amortization Schedule Using Google Spreadsheet

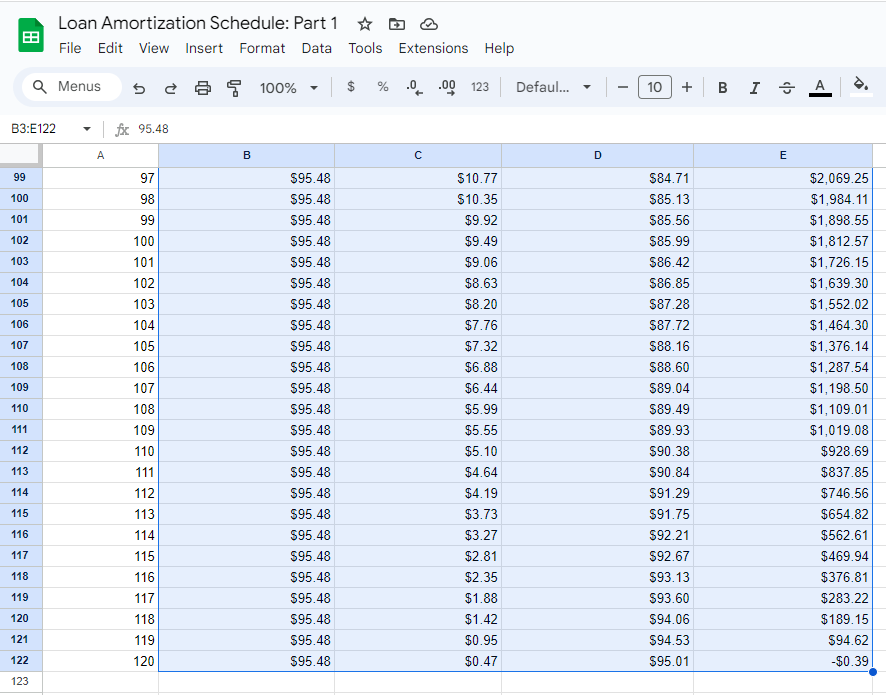

Example 1: Consider a $8,600 loan with payments every month, an APR of 6%, and a

loan term of 10

years.

Prepare a table showing the interest payment and loan balance after each month.

Assume a monthly payment of $95.48

Solution:

(1.) Visit Google Spreadsheets: https://spreadsheets.google.com/

(2.) Begin a new spreadsheet

(3.) Write the title

In this example, I shall write: Loan Amortization Schedule: Part 1

I intend to do more examples.

(4.) Given:

Principal, P = $8600

Interest rate, APR = r = 6% = 0.06

Time, t = 10 years = 10(12) months = 120 months

Monthly Payment, PMT = $95.48

To Prepare: Loan Amortization Schedule

Calculate:

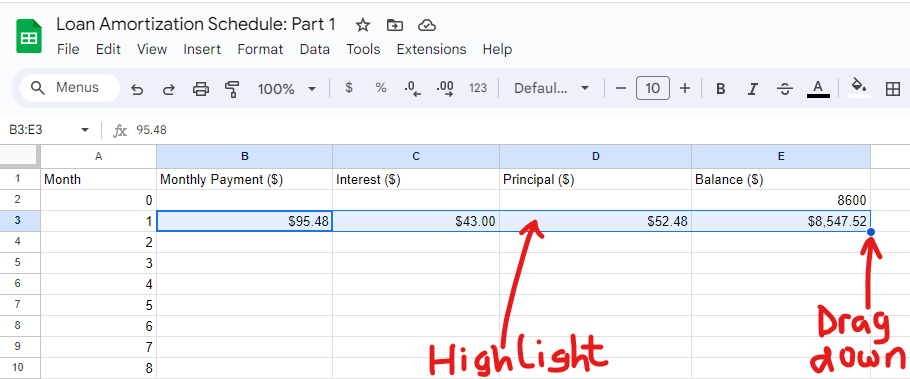

Let us do for the first month.

Then, we shall use Google Spreadsheet technology to get all values for the remaining months.

$

Interest\;\;per\;\;month,\;\; SI \\[3ex]

= P * r * t \\[3ex]

= 8600 * 0.06 * \dfrac{1}{12} \\[5ex]

= \$43.00 \\[3ex]

$

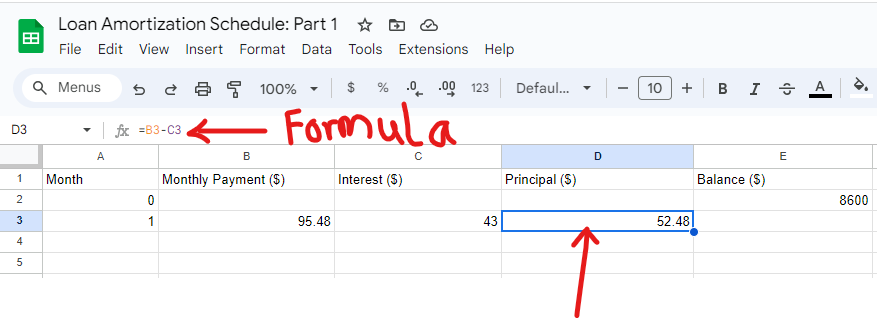

Notice the formula in C3

$

Amount\;\;paid\;\;towards\;\;the\;\;Principal \\[3ex]

= PMT - SI \\[3ex]

= 95.48 - 43 \\[3ex]

= \$52.48 \\[3ex]

$

Notice the formula in D3

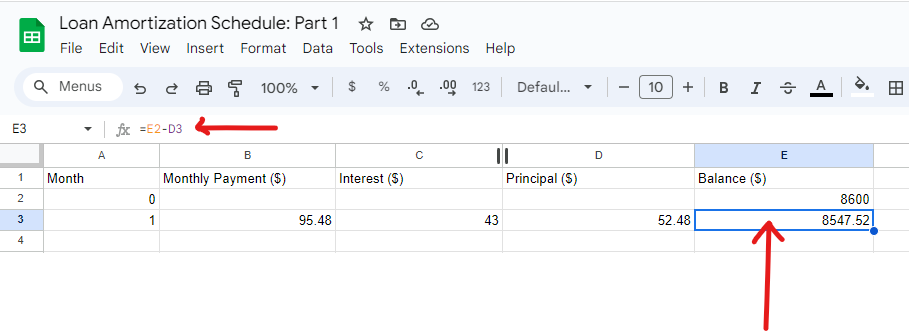

$

New\;\;Balance \\[3ex]

= Previous\;\;Balance - Prncipal \\[3ex]

= 8600 - 52.48 \\[3ex]

= \$8547.52 \\[3ex]

$

Notice the formula in E3

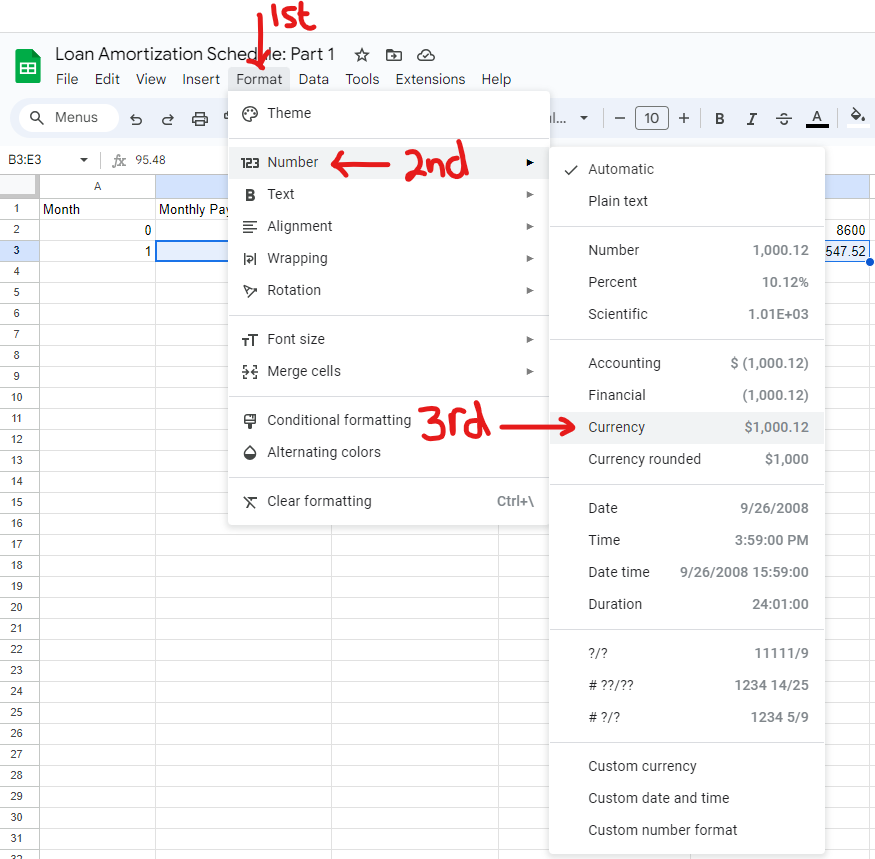

Let us format all currency to two decimal places.

This gives us the apprximate values (not exact values).

To find exact values, please do not format the currencies.

Highlight the cells to format and click Format menu, then → Number then

→ Currency

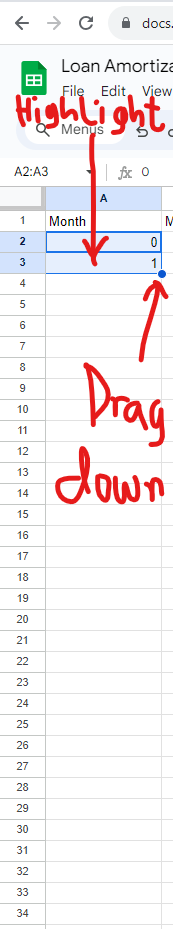

Next, let us get all the numbers for the monthly payments.

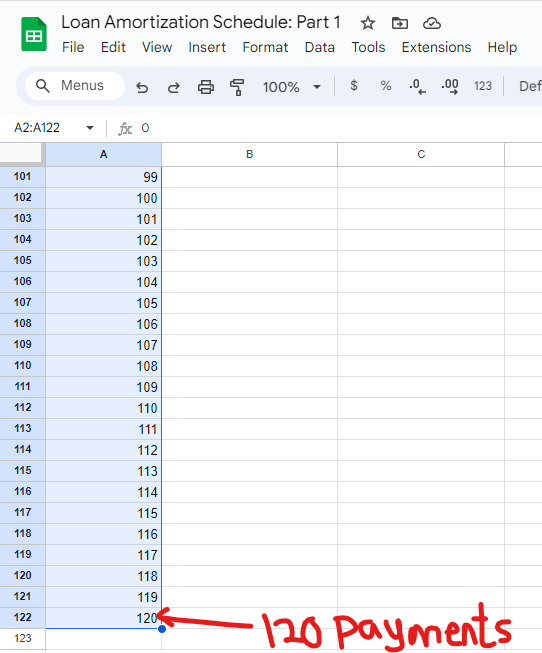

There are 120 payments. (every month for 10 years)

So far we have Number 0 and Number 1

Number 0 does not really count because that is the month the loan was taken.

The payment begins from Month 1 through Month 120

But we have to highlight Numbers 0 and 1 so the spreadsheet knows that we want a linear increment of 1

(count of 1) for 120 months.

Highlight the Month cell and then move to the lower right corner.

Pull/drag the shaded circle down. Begin to pull when you see a cross.

Keep pulling/dragging until you reach 120 counts/payments

We now want to get all the values for the remaining months.

Highlight the remaining cells as applicable and then move to the lower right corner of the last cell and

pull/drag the shaded circle down.

Begin to pull when you see a cross.

Keep pulling/dragging until you get all the values for 120 payments

References

Chukwuemeka, S.D (2016, April 30). Samuel Chukwuemeka Tutorials - Math, Science, and Technology.

Retrieved from https://quantitativereasoning.appspot.com/

Bennett, J. O., & Briggs, W. L. (2019). Using and Understanding Mathematics: A Quantitative Reasoning

Approach. Pearson.

Bennett, J. O., & Briggs, W. L. (2023). Using and Understanding Mathematics: A Quantitative Reasoning

Approach. Pearson.

Blitzer, R. (2015). Thinking Mathematically (6th ed.).

Boston: Pearson

Cleaves, C. S., Hobbs, M. J., & Noble, J. J. (2014). Business Math (10th ed.).

Upper Saddle River, NJ: Prentice Hall.

Tan, S. (2015). Finite Mathematics for the Managerial, Life, and Social Sciences (11th ed.).

Boston: Cengage Learning.

Microsoft Office Clip Art. (n.d.). Retrieved from

https://support.office.com/en-us/article/add-clip-art-to-your-file-0a01ae25-973c-4c2c-8eaf-8c8e1f9ab530?legRedir=true&CorrelationId=9c8bb412-68e2-4db0-9704-c9af116e2521&ui=en-US&rs=en-US&ad=US

Authority (NZQA), (n.d.). Mathematics and Statistics subject resources. www.nzqa.govt.nz. Retrieved

December 14,

2020, from https://www.nzqa.govt.nz/ncea/subjects/mathematics/levels/

CrackACT. (n.d.). Retrieved from http://www.crackact.com/act-downloads/

CMAT Question Papers CMAT Previous Year Question Bank - Careerindia. (n.d.).

https://www.careerindia.com. Retrieved

May 30, 2020, from https://www.careerindia.com/entrance-exam/cmat-question-papers-e23.html

CSEC Math Tutor. (n.d). Retrieved from https://www.csecmathtutor.com/past-papers.html

TI Products | Calculators and Technology | Texas Instruments. (n.d.). Education.ti.com. Retrieved March

18, 2023, from https://education.ti.com/en/products

Desmos. (n.d.). Desmos Graphing Calculator. https://www.desmos.com/calculator

Durante, A. (2022, October 18). 2023 Tax Brackets. Tax Foundation.

https://taxfoundation.org/2023-tax-brackets/

DLAP Website. (n.d.). Curriculum.gov.mt.

https://curriculum.gov.mt/en/Examination-Papers/Pages/list_secondary_papers.aspx

Free Jamb Past Questions And Answer For All Subject 2020. (2020, January 31). Vastlearners.

https://www.vastlearners.com/free-jamb-past-questions/

Geogebra. (2019). Graphing Calculator - GeoGebra. Geogebra.org.

https://www.geogebra.org/graphing?lang=en

GCSE Exam Past Papers: Revision World. Retrieved April 6, 2020, from

https://revisionworld.com/gcse-revision/gcse-exam-past-papers

HSC exam papers | NSW Education Standards. (2019). Nsw.edu.au.

https://educationstandards.nsw.edu.au/wps/portal/nesa/11-12/resources/hsc-exam-papers

JAMB Past Questions, WAEC, NECO, Post UTME Past Questions. (n.d.). Nigerian Scholars. Retrieved February

12, 2022,

from https://nigerianscholars.com/past-questions/

KCSE Past Papers by Subject with Answers-Marking Schemes. (n.d.). ATIKA SCHOOL.

Retrieved June 16, 2022, from https://www.atikaschool.org/kcsepastpapersbysubject

Myschool e-Learning Centre - It's Time to Study! - Myschool. (n.d.). https://myschool.ng/classroom

Netrimedia. (2022, May 2). ICSE 10th Board Exam Previous Papers- Last 10 Years. Education Observer.

https://www.educationobserver.com/icse-class10-previous-papers/

NSC Examinations. (n.d.). www.education.gov.za.

https://www.education.gov.za/Curriculum/NationalSeniorCertificate(NSC)Examinations.aspx

School Curriculum and Standards Authority (SCSA): K-12. Past ATAR Course Examinations. Retrieved

December 10, 2021,

from https://senior-secondary.scsa.wa.edu.au/further-resources/past-atar-course-exams

West African Examinations Council (WAEC). Retrieved May 30, 2020, from

https://waeconline.org.ng/e-learning/Mathematics/mathsmain.html

Papua New Guinea: Department of Education. (n.d.). www.education.gov.pg. Retrieved November 24, 2020,

from

http://www.education.gov.pg/TISER/exams.html

51 Real SAT PDFs and List of 89 Real ACTs (Free) : McElroy Tutoring. (n.d.).

Mcelroytutoring.com. Retrieved December 12, 2022,

from

https://mcelroytutoring.com/lower.php?url=44-official-sat-pdfs-and-82-official-act-pdf-practice-tests-free