(19.) Use only technology (no formulas), preferably the TVM app in the TI-series calculators to solve

these questions.

Show the screenshots of your solutions.

Interpret your answers in the context of the question.

(I.) You want to purchase a new car in 9 years and expect the car to cost $86,000.

Your bank offers a plan with a guaranteed APR of 5.5% if you make regular monthly deposits.

How much should you deposit each month to end up with $86,000 in 9 years?

(II.) Consider the pair of savings plans below.

Hannah deposits $60 per month in an account with an APR of 4%, while Sarah deposits $190 per quarter in an account with an APR of 4.5%.

Compare the balances in each plan after 14 years.

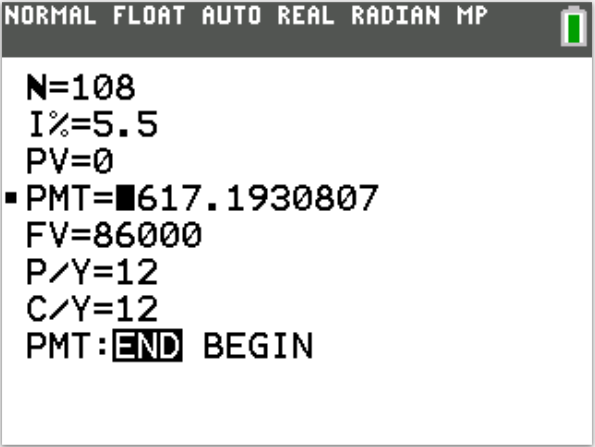

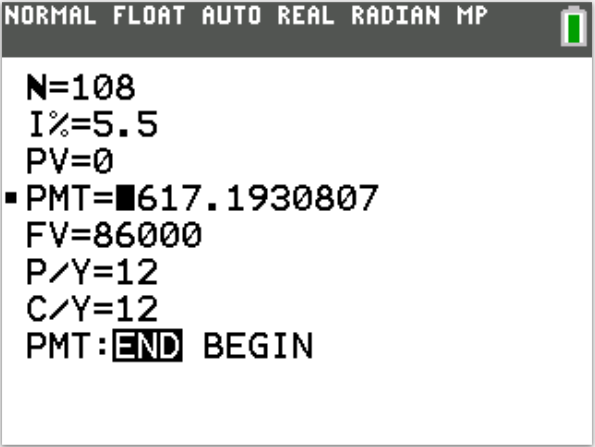

(I.) This is a case of Sinking Funds

$N = mt = 12 * 9 = 108$

You should invest $617.19 each month.

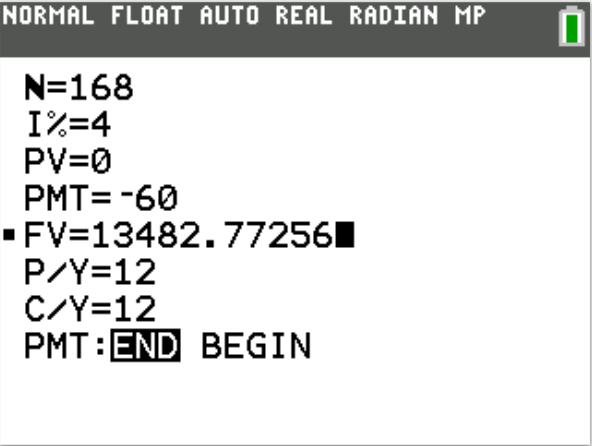

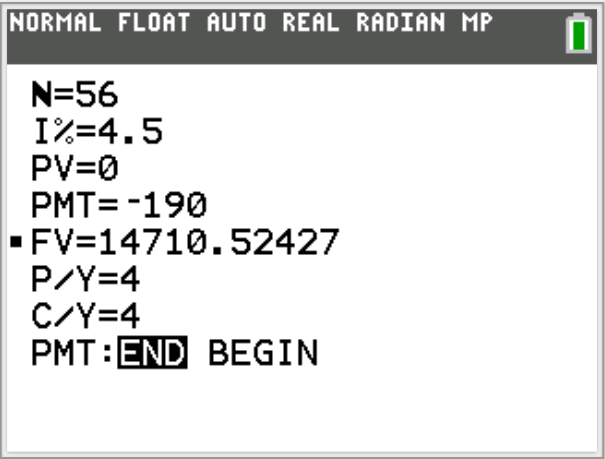

(II.) This is a case of Future Value of Ordinary Annuity

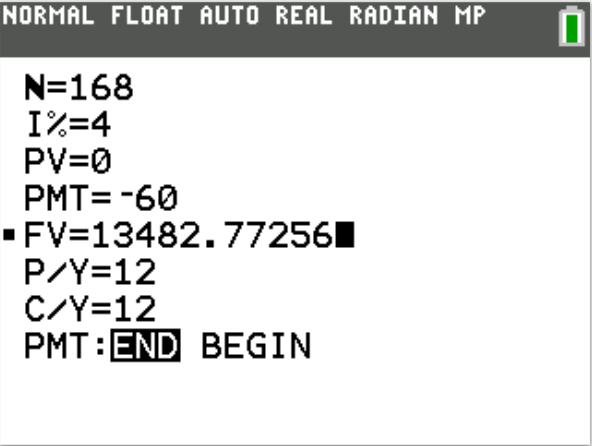

Hannah: $N = mt = 12 * 14 = 168$

The balance in Hannah's account is $13482.77

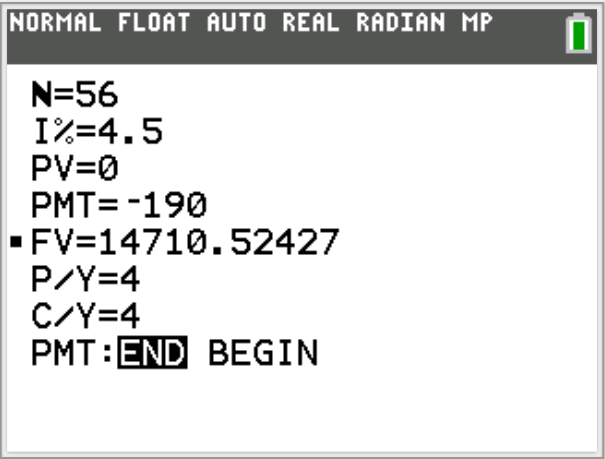

Sarah: $N = mt = 4 * 14 = 56$

P/Y = 4

C/Y = m = 4

The balance in Sarah's account is $14710.52

Show the screenshots of your solutions.

Interpret your answers in the context of the question.

(I.) You want to purchase a new car in 9 years and expect the car to cost $86,000.

Your bank offers a plan with a guaranteed APR of 5.5% if you make regular monthly deposits.

How much should you deposit each month to end up with $86,000 in 9 years?

(II.) Consider the pair of savings plans below.

Hannah deposits $60 per month in an account with an APR of 4%, while Sarah deposits $190 per quarter in an account with an APR of 4.5%.

Compare the balances in each plan after 14 years.

(I.) This is a case of Sinking Funds

$N = mt = 12 * 9 = 108$

You should invest $617.19 each month.

(II.) This is a case of Future Value of Ordinary Annuity

Hannah: $N = mt = 12 * 14 = 168$

The balance in Hannah's account is $13482.77

Sarah: $N = mt = 4 * 14 = 56$

P/Y = 4

C/Y = m = 4

The balance in Sarah's account is $14710.52

(20.) Choose the best answer to the following question.

Explain your reasoning.

What is the total return on a 28-year investment?

A. It is the value of the investment after 28 years.

The total return is equal to the overall growth over t years.

B. It is the difference between the final and initial values of the investment.

The initial value is how much was invested and the final value is equal to the initial value plus the total return.

C. It is the relative change in the value of the investment.

The total return shows the percentage change as the value of the investment changes.

D. It is the value of the investment after 28 years.

Time is the only factor that affects total return.

As the length of time of the investment increases, the total return increases.

E. It is the difference between the final and initial values of the investment.

This shows how much money was made from the initial investment after 28 years.

F. It is the relative change in the value of the investment.

Then, subtract one from this value to determine the annual return.

C. It is the relative change in the value of the investment.

The total return shows the percentage change as the value of the investment changes.

Explain your reasoning.

What is the total return on a 28-year investment?

A. It is the value of the investment after 28 years.

The total return is equal to the overall growth over t years.

B. It is the difference between the final and initial values of the investment.

The initial value is how much was invested and the final value is equal to the initial value plus the total return.

C. It is the relative change in the value of the investment.

The total return shows the percentage change as the value of the investment changes.

D. It is the value of the investment after 28 years.

Time is the only factor that affects total return.

As the length of time of the investment increases, the total return increases.

E. It is the difference between the final and initial values of the investment.

This shows how much money was made from the initial investment after 28 years.

F. It is the relative change in the value of the investment.

Then, subtract one from this value to determine the annual return.

C. It is the relative change in the value of the investment.

The total return shows the percentage change as the value of the investment changes.