(3.) Compute the total and annual returns on these investments.

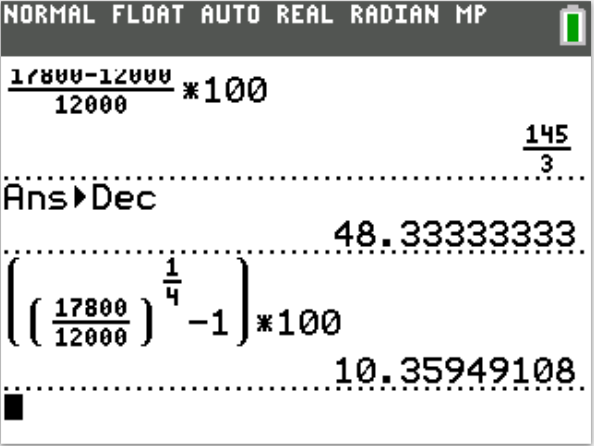

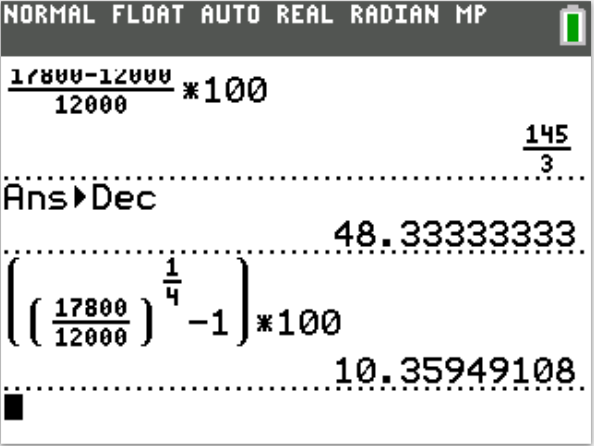

(I.) Four years after buying 150 shares of XYZ stock for $80 per share, you sell the stock for $17,800

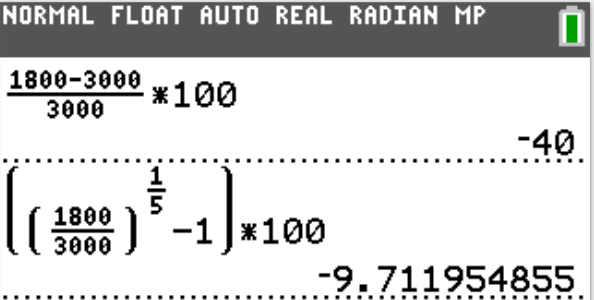

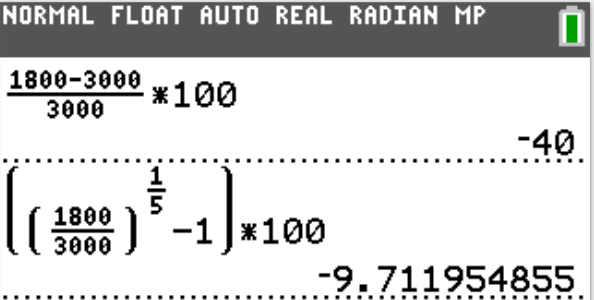

(II.) Five years after paying $3000 for shares in a startup company, you sell the shares for $1800 (at a loss).

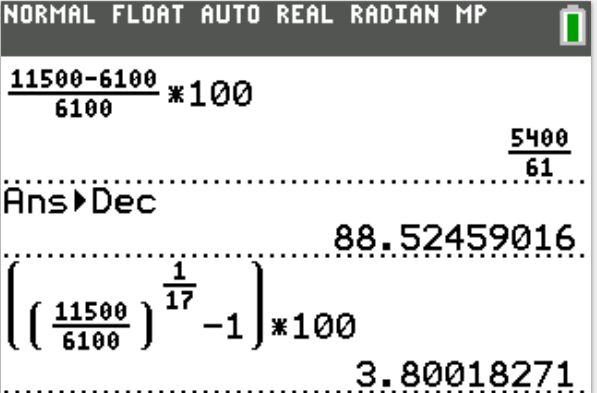

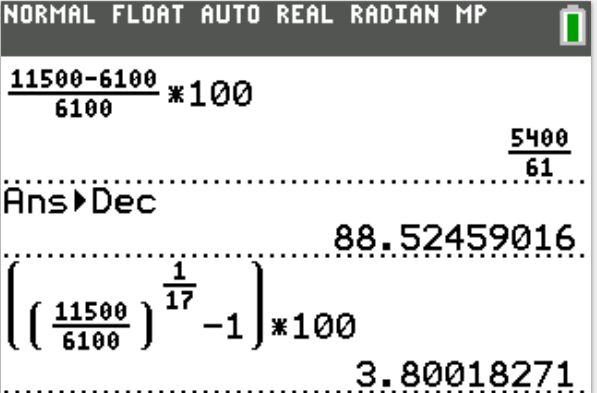

(III.) You pay $6100 for a municipal bond.

When it matures after 17 years, you receive $11,500

$ (I.) \\[3ex] P = 150(80) = \$12000 \\[3ex] A = \$17800 \\[3ex] t = 4\;years \\[3ex] Total\;\;Return = \dfrac{A - P}{P} * 100\% \\[5ex] = \dfrac{17800 - 12000}{12000} * 100 \\[5ex] = 48.33333333\% \\[5ex] Annual\;\;Return = \left[\left(\dfrac{A}{P}\right)^{\dfrac{1}{t}} - 1\right] * 100\% \\[7ex] = \left[\left(\dfrac{17800}{12000}\right)^{\dfrac{1}{4}} - 1\right] * 100\% \\[7ex] = 10.35949108\% \\[3ex] $

$ (II.) \\[3ex] P = \$3000 \\[3ex] A = \$1800 \\[3ex] t = 5\;years \\[3ex] Total\;\;Return = \dfrac{A - P}{P} * 100\% \\[5ex] = \dfrac{1800 - 3000}{3000} * 100 \\[5ex] = -40\% \\[5ex] Annual\;\;Return = \left[\left(\dfrac{A}{P}\right)^{\dfrac{1}{t}} - 1\right] * 100\% \\[7ex] = \left[\left(\dfrac{1800}{3000}\right)^{\dfrac{1}{5}} - 1\right] * 100\% \\[7ex] = -9.711954855\% \\[3ex] $

$ (III.) \\[3ex] P = \$6100 \\[3ex] A = \$11500 \\[3ex] t = 17\;years \\[3ex] Total\;\;Return = \dfrac{A - P}{P} * 100\% \\[5ex] = \dfrac{11500 - 6100}{6100} * 100 \\[5ex] = 88.52459016\% \\[5ex] Annual\;\;Return = \left[\left(\dfrac{A}{P}\right)^{\dfrac{1}{t}} - 1\right] * 100\% \\[7ex] = \left[\left(\dfrac{11500}{6100}\right)^{\dfrac{1}{17}} - 1\right] * 100\% \\[7ex] = 3.80018271\% \\[3ex] $

(I.) Four years after buying 150 shares of XYZ stock for $80 per share, you sell the stock for $17,800

(II.) Five years after paying $3000 for shares in a startup company, you sell the shares for $1800 (at a loss).

(III.) You pay $6100 for a municipal bond.

When it matures after 17 years, you receive $11,500

$ (I.) \\[3ex] P = 150(80) = \$12000 \\[3ex] A = \$17800 \\[3ex] t = 4\;years \\[3ex] Total\;\;Return = \dfrac{A - P}{P} * 100\% \\[5ex] = \dfrac{17800 - 12000}{12000} * 100 \\[5ex] = 48.33333333\% \\[5ex] Annual\;\;Return = \left[\left(\dfrac{A}{P}\right)^{\dfrac{1}{t}} - 1\right] * 100\% \\[7ex] = \left[\left(\dfrac{17800}{12000}\right)^{\dfrac{1}{4}} - 1\right] * 100\% \\[7ex] = 10.35949108\% \\[3ex] $

$ (II.) \\[3ex] P = \$3000 \\[3ex] A = \$1800 \\[3ex] t = 5\;years \\[3ex] Total\;\;Return = \dfrac{A - P}{P} * 100\% \\[5ex] = \dfrac{1800 - 3000}{3000} * 100 \\[5ex] = -40\% \\[5ex] Annual\;\;Return = \left[\left(\dfrac{A}{P}\right)^{\dfrac{1}{t}} - 1\right] * 100\% \\[7ex] = \left[\left(\dfrac{1800}{3000}\right)^{\dfrac{1}{5}} - 1\right] * 100\% \\[7ex] = -9.711954855\% \\[3ex] $

$ (III.) \\[3ex] P = \$6100 \\[3ex] A = \$11500 \\[3ex] t = 17\;years \\[3ex] Total\;\;Return = \dfrac{A - P}{P} * 100\% \\[5ex] = \dfrac{11500 - 6100}{6100} * 100 \\[5ex] = 88.52459016\% \\[5ex] Annual\;\;Return = \left[\left(\dfrac{A}{P}\right)^{\dfrac{1}{t}} - 1\right] * 100\% \\[7ex] = \left[\left(\dfrac{11500}{6100}\right)^{\dfrac{1}{17}} - 1\right] * 100\% \\[7ex] = 3.80018271\% \\[3ex] $

(4.)