(9.) Choose the best answer to the following question.

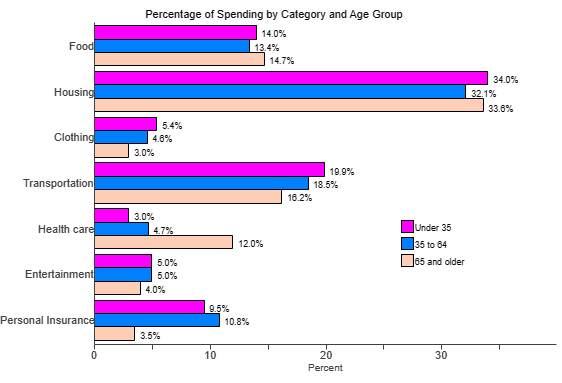

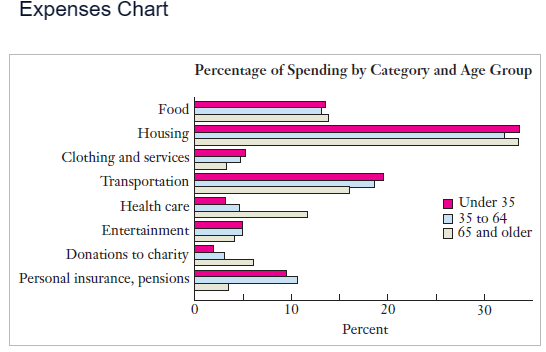

For the average person, what is the single biggest category of expense?

A. The single biggest category is housing.

The average person uses 33% of his or her income on housing.

B. The single biggest category is food.

The average person uses 23%-43% of his or her income on food.

C. The single biggest category is food.

The average person uses 46%-66% of his or her income on food.

D. The single biggest category is entertainment.

The average person has not yet considered finding lower-cost entertainment options.

E. The single biggest category is housing.

The average person uses 23% of his or her income on housing.

F. The single biggest category is entertainment.

The average person spends 8% of his or her income on entertainment.

A. The single biggest category is housing.

The average person uses 33% of his or her income on housing.

For the average person, what is the single biggest category of expense?

A. The single biggest category is housing.

The average person uses 33% of his or her income on housing.

B. The single biggest category is food.

The average person uses 23%-43% of his or her income on food.

C. The single biggest category is food.

The average person uses 46%-66% of his or her income on food.

D. The single biggest category is entertainment.

The average person has not yet considered finding lower-cost entertainment options.

E. The single biggest category is housing.

The average person uses 23% of his or her income on housing.

F. The single biggest category is entertainment.

The average person spends 8% of his or her income on entertainment.

A. The single biggest category is housing.

The average person uses 33% of his or her income on housing.

(10.) Choose the best answer to the following question.

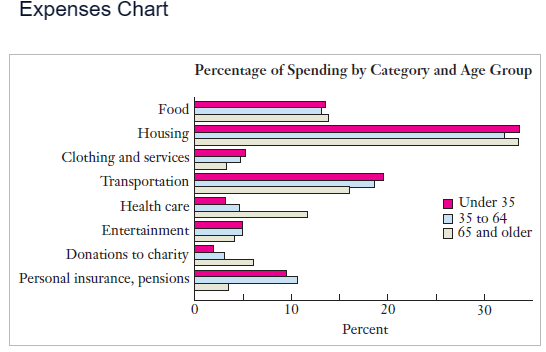

What will evaluating your monthly budget help you learn?

A. You learn how to keep your personal spending under control.

You could be spending a lot more in certain categories than you had imagined and that the items you thought were causing the biggest difficulties are small compared to other items.

B. You learn how to earn more money.

You may figure out that you are good at managing finances, and then become a wealthy financial advisor.

C. You learn how to make better investments.

You may notice that you are spending a higher percentage of your money on entertainment than the average person.

D. You learn how to make better investments.

You may notice that you made a poor investment that is causing you to lose money every month.

E. You learn how to earn more money.

You may realize that you should start working more hours every week to increase your monthly cash flow.

F. You learn how to keep your personal spending under control.

Once you evaluate your current budget, you'll almost certainly want to make changes to improve your cash flow.

A. You learn how to keep your personal spending under control.

You could be spending a lot more in certain categories than you had imagined and that the items you thought were causing the biggest difficulties are small compared to other items.

What will evaluating your monthly budget help you learn?

A. You learn how to keep your personal spending under control.

You could be spending a lot more in certain categories than you had imagined and that the items you thought were causing the biggest difficulties are small compared to other items.

B. You learn how to earn more money.

You may figure out that you are good at managing finances, and then become a wealthy financial advisor.

C. You learn how to make better investments.

You may notice that you are spending a higher percentage of your money on entertainment than the average person.

D. You learn how to make better investments.

You may notice that you made a poor investment that is causing you to lose money every month.

E. You learn how to earn more money.

You may realize that you should start working more hours every week to increase your monthly cash flow.

F. You learn how to keep your personal spending under control.

Once you evaluate your current budget, you'll almost certainly want to make changes to improve your cash flow.

A. You learn how to keep your personal spending under control.

You could be spending a lot more in certain categories than you had imagined and that the items you thought were causing the biggest difficulties are small compared to other items.